French exit activity continues rebound in Q2

French GPs have increasingly been divesting assets in recent quarters, with local exit activity narrowing the gap with the UK, according to unquoteт data.

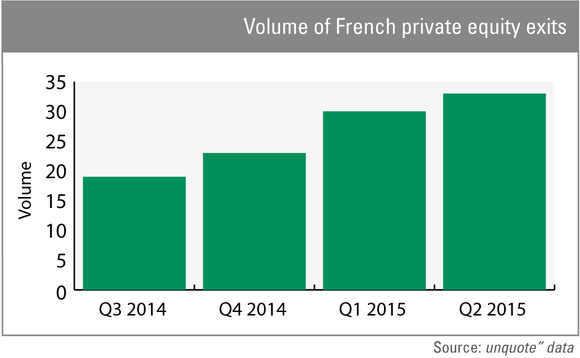

France is the only European market that has seen exit activity gain momentum quarter-on-quarter in the past year, according to figures sourced from the unquote" proprietary database. The country was home to 33 divestments by private equity firms in Q2 this year; this figure has grown steadily for each quarter since Q3 2014, when unquote" recorded just 19 exits from French portfolio companies.

The UK has remained the most active European market for divestment across the same period, but a notable dip in Q2 2015 with 44 exits on record means that the gap with France has narrowed. Other markets that have seen dwindling exit figures in the past 12 months include the Nordic region (particularly in H1 this year as divestment activity fell to 24 deals in Q1 and 19 in Q2) and the Benelux countries (from 22 deals in Q3 2014 to just 11 in Q2 2015).

The DACH region has seen more stable levels of activity over this period, but was overtaken by France as divestments slowed further in the first three months of 2015.

Spice of life

Delving further into the numbers shows GPs have been increasingly successful at tapping into a variety of exit routes to divest French assets. Secondary buyouts remain a firm favourite, accounting for nearly half of the exits completed in Q2 this year. Notable transactions included 21 Partners selling its majority stake in Vacalians to Permira in a deal understood to be worth €400m, as well as LBO France selling air transportation equipment group Alvest to Sagard for an estimated €250-300m.

But private equity houses have also been keener on tapping into the public markets, with seven IPOs launched in H1 2015 against none in the second half of last year. Such listings included that of Spie by Clayton Dubilier & Rice and Ardian (€2.5bn market cap) as well as Europcar by Eurazeo (€1.69bn market cap). Trade sales also rebounded in 2015 with nine transactions per quarter, against four and five in Q3 2014 and Q4 2014 respectively.

July has so far seen GPs stick to this busy divestment schedule, with 12 exits recorded by unquote" in a single month, including the €950m sale of Vitalia by Blackstone and the €1.5bn SBO of Linxens. But deal-doing is now expected to come to a traditional halt in France over August, meaning that Q3 exit figures are always unlikely to match those seen in the second quarter.

Furthermore, though the rebound in the French market over the past 12 months is welcome, exits were much more plentiful in the second half of 2013 (44 divestments per quarter on average) and in the second quarter of last year – the 50 exits recorded between April and July 2014 dwarf the 33 seen in Q2 this year.

For a complete statistical overview of the European private equity market in the second quarter, look out for the upcoming unquote" Private Equity Barometer, published in association with SL Capital Partners.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds