Can venture cash in on Skype success?

Venture has just cashed in on Skype – again. Such successes are rare, meaning LPs need more convincing before investing more in the asset class. Viktor Lundvall investigates

Europe (finally) has another venture homerun to shout about. Silver Lake Partners has just reaped a $2.9bn windfall from its $940m investment in Skype after Microsoft bought it for a staggering $8.5bn this week. SilverLake led a consortium that took the asset off eBay's hands just 18 months before cashing in.

LPs like this kind of story. But it's all too rare in Europe. On average, a typical European venture fund has produced negative returns, across all vintages.

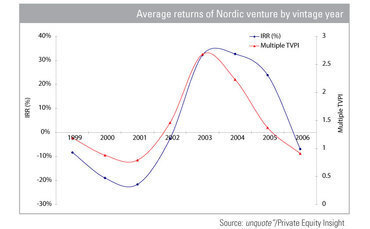

Despite its penchant for homeruns, Nordic returns on average fare little better than the European counterparts. Data generated from unquote" (see graph) shows that deals that were completed prior to 2003 generated negative returns on average, likely due to the bursting of the dotcom bubble. Investments that were made in the years directly following this have managed to generate positive returns, albeit at much lower IRRs and multiples compared to the buyout industry.

Interestingly, the multiple TVPI fell below the IRR for 2004 and 2005. This suggests that GPs were able to exit their investments quickly in the positive economic climate in the run up to the recent financial crisis. The shining example of a European venture homerun is Skype, which received seed funding in 2003 and additional investment in 2004 from Index and DFJ, only to be sold a year later to eBay for $2.6bn. This week, the aforementioned Silver Lake, as well as Andreessen Horowitz and the Canada Pension Plan Investment Board, cashed in again on Skype when Microsoft bought it for $8.5bn.

Such a fantastic return, however, remains rare. "There is a great disinterest among Nordic LPs to invest in venture," says Pär-Jörgen Pärson, partner at Northzone Ventures. "Many VCs failed miserably during the dotcom crash and burned their investors," he adds.

Jimmy Fussing Nielsen, managing partner, Sunstone Capital, agrees that it is difficult to get LPs on board: "The appetite among Nordic LPs (for venture) is very low. Since 2007, annual European VC fundraising has fallen by 75%, which reflects the situation in the Nordics. The problem is that LPs currently do not see venture as an asset class that can generate good returns on average." Furthermore, the fact that the Nordic buyout industry has performed strongly means that LPs are, understandably, more interested in buyout funds.

In order to attract investors, it is important to show LPs that venture can deliver returns. The problem is that venture investments often require a longer holding period than for buyouts, meaning that it is difficult to show the performance of recent deals. "If you cannot document competitive returns, you will not be able to raise a fund. LPs want proof of performance, not just a promise," says Nielsen. However, Nielsen adds that venture exits this year and next will generate strong returns, as will deals done in this vintage.

Although venture has underperformed on average, recent changes in the Nordic industry have inspired confidence among the active players in the region. A more in-depth analysis of the state of the Nordic venture industry and its prospects for the future will be published in the Nordic Report 2011, which will be made available at the Nordic unquote" Private Equity Congress in Stockholm on 31 May.

For more information about the Nordic Private Equity Congress and to book your place, click here.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds