UK dominant as European deal activity stumbles

The UK has reasserted its dominance as a European private equity market in 2012, racing ahead of the competition, according to figures from unquoteт data.

While last year many speculated that France might soon claim the UK's crown as Europe's largest private equity market, difficult economic conditions have left the country trailing behind Britain, with almost half the amount of activity across all stages.

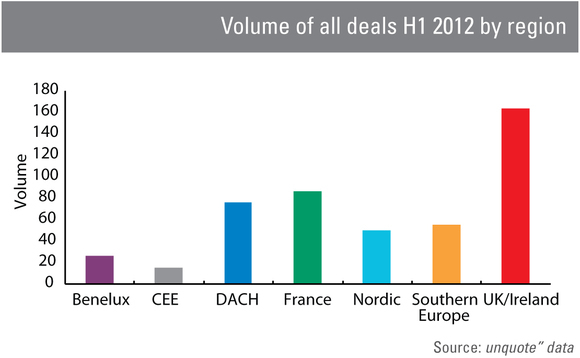

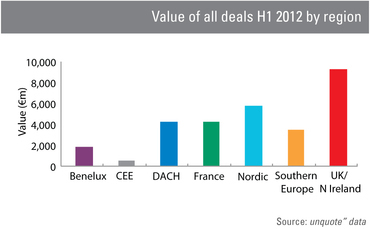

In the first six months of 2012, the UK & Ireland region saw a total of 163 deals valued at an overall €9.35bn. By contrast, France saw just 86 deals totalling €4.24bn.

While some mega deals have certainly helped the UK's total, with the buyouts of Misys and CPA Global both exceeding €1bn, the two deals combined account for just €2.6bn, indicating a consistent number of mid-market transactions are driving the UK market forward.

In value terms, France was, surprisingly, lagging in fourth place. The Nordic countries saw the second largest total deal value, with €5.78bn invested across 50 deals, helped on by the €1.8bn acquisition of Ahlsell by CVC in February, as well as a string of upper mid-market deals. DACH too just edged ahead of France with €4.31bn of investments across 76 transactions.

The UK was also the only region to see an increase in deal activity compared with the same period in 2011, with 11 more deals at the end of June. Value was down, though only slightly, from €10.42bn a year ago.

Deal numbers in France and DACH are sharply down, with France seeing a 41% fall from 145 deals in H1 2011, while DACH volume fell 44% from 135 in the same period. French deal values also suffered a major contraction, falling by 64% from €11.82bn a year ago to just €4.24bn today.

Nordic countries saw the biggest fall in deal number, down 51% from the 102 recorded at the end of H1 2011. However, deal value held up reasonably well, falling just 23%.

While all regions have suffered, the fairly poor performance of France is particularly notable, given the region was extremely active last year, with deal levels approaching those of the UK for the first time ever, as noted by unquote". However, the presidential election, credit downgrade and eurozone crisis have all taken their toll and impacted French deal values. Political issues in particular, which have seen the socialists take power in France, are thought to be a reason why many French deal-doers are holding their cards close to their chests, waiting to see how the political landscape changes before making any significant investments.

France's standing in the European landscape was also hurt by an absence of large-cap deals in the first half of 2012: the country has not been home to a single €1bn+ buyout this year, while it witnessed three such deals in 2011. France's mid-market, although significantly less buoyant compared to last year, has meanwhile performed reasonably well compared to its neighbours – France took second place behind the UK in terms mid-cap activity level in the first half of 2012.

If current dour market conditions continue until the end of the year, then 2012 could see the lowest level of private equity activity in Europe since 2009, highlighting the severity of the new economic crisis currently gripping the eurozone.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds