Large exits up 60% year-on-year

So far, 2011 has seen a surge in exit activity for private equity funds, with large-scale divestments seeing a significant recovery in particular. John Bakie gives an overview

With the onslaught of the financial crisis and the collapse of Lehman Brothers, M&A activity across Europe came to an abrupt halt. With banks unwilling or unable to lend and corporates concerned about falling revenues, few were interested in buying companies, which meant many sellers had to bide their time.

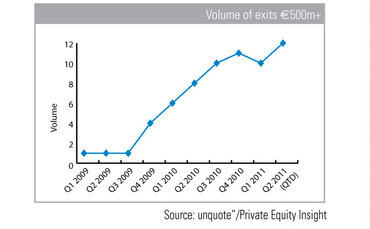

Private equity funds were in a particularly difficult situation, with those in their divestment period struggling to sell, while investing managers were unable to obtain finance to support the next generation of investments. While this hit exit activity across the board, larger exits of companies worth €500m or more were badly affected, as can be seen from the graph below.

With just seven exits worth more than half a billion euros in 2009, and more than half taking place only in the final quarter of the year, it is perhaps unsurprising so many funds were seeking extensions due to dire market conditions. While the issue has provoked some controversy, it was likely a sensible precaution to hold onto financially sound businesses until a better price could be achieved.

The trend continued through 2010 and into this year, with the number of large exits in 2011 set to beat the whole of 2010 if current trends continue. So far this year, 22 private equity portfolio companies worth more than €500m have been sold. Among the most high-profile are the €2.47bn sale of Cinven-owned Phadia to Thermo Fisher Scientific Inc, and Silverlake's disposal of Skype, which was bought by Microsoft for $8.5bn. Top-end exits are up 60% in Q1 2011 compared with the same period last year.

More exits at the top end of the market are also on the horizon, with PAI currently holding an auction of engineering group Spie, which is expected to fetch around €2bn.

With many managers looking to raise new funds in the coming months, the ability to prove to investors that they can profitably sell portfolio companies is vital. It is equally important for LPs to start receiving distributions for their funds as, with growing competition from emerging markets funds, GPs will want to make sure their investors have plenty of cash in their pockets to back the next round of fundraising.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds