Buyouts: All-equity deals on the wane

All equity buyouts have been a common feature in the private equity market since the onset of the financial crisis. Driven by poor leverage availability and high prices at the time, this trend is now in decline as markets return to normal. John Bakie gives an overview

When Lehman Brothers collapsed in late 2008, world debt markets froze and years of cheap and easy debt availability came to an end. The private equity industry was forced to adapt to this new environment and unquote" noted a marked increase in the number of all-equity deals in the immediate aftermath of the crisis.

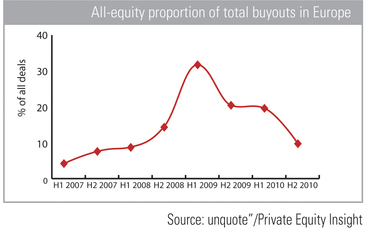

unquote" Research figures show the rapid increase in the proportion of buyouts completing as an all-equity transaction, with no debt arrangements in place at the time of the acquisition. While this does not necessarily mean the private equity buyer has no intention of using debt - with some choosing to leverage in the later years of the investment - it does hint at the scale of the problems encountered during the financial crisis.

As indicated in the chart above, the upward trend in all-equity buyouts is already evident between H1 2007 and H2 2008, when the US sub-prime mortgage crisis first rattled the world's banks. However, Lehman's collapse towards the end of 2008, led to a spike in all-equity transactions, with their proportion rising from 24% in H2 2008 to over 40% just six months later. Clearly the financial crisis was taking its toll on buyout funding.

However, it seems leverage conditions are now improving, dropping to 30% in late 2009 as markets calmed and the world's major economies left recession. At the end of 2010, this has fallen even further, with all-equity transactions accounting for just 20% of deals.

All-equity buyouts still remain more common than they were pre-crisis, when less than 15% of deals used no debt at the transaction stage. Despite this, these figures hint at moderately improving debt terms for deal doers. But, with Basel III regulations and further fears over some of Europe's weaker economies, it may be some time before leverage is as cheap and easy to come by as it was before the credit crunch.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds