The unquote" forecast: Total buyouts fall by 22% in 2012

After buyouts picked up again in 2010 and 2011, this year's forecast predicts a drop in both value and volume. Anneken Tappe reports

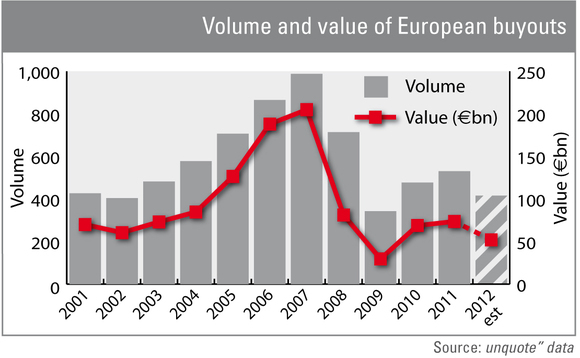

Over the past decade, buyouts from the first three quarters of the year have accounted for an average of 74% in full-year volume and 73% in total value across Europe. Extrapolating from this data, this year's buyouts are due to total 416 deals, 22% less than last year. That is the biggest slump in year-on-year deal volume since 2009, when total transactions fell 52% to the year prior.

In terms of value, the outlook is even worse. With a total forecast transaction value of €52m by year end, this figure is down almost 30% in comparison to 2011. In line with the performance of deal volume, this is the worst percentage change from one year to the next since 2008/2009, when value slumped 63%.

The key economic drivers that are responsible for 2012's poor performance were already a factor in late 2011 – Greece's crippling debts and tough lending conditions due to the poor recovery from the 2008-2009 financial crisis.

In early 2011, it appeared that many investors were hopeful that the economy would pick up in 2012. Growth and economic stability would have ameliorated bank lending conditions and steered leveraged buyouts back towards the years of glory. Instead, investment conditions have worsened, because alongside banks, fund investors grew increasingly careful in their commitments. By now, many LPs have been forced to re-allocate their investments and employ a more selective strategy, causing fundraising conditions to worsen for GPs without an A* track record. Investor confidence was knocked to a low after the crisis in Greece picked up in terms of complexity and market impact in Q4 2011, the results of which can be seen in the 2012 statistics from unquote" data.

Europe's buyout market saw its strongest year on record in 2007, when deal volume hit 988 transactions worth €205bn. Much has changed since then. The most significant decrease in activity as well as money deployed was seen in 2009, but the promised recovery has still not happened.

In 2013, European private equity will have to face a whole new problem, as the repayments or recapitalisations of the so-called wall of debt of leverage repayments due until 2020 are expected to peak in 2013 and 2014. With bank lending this slow, there is an immediate need for new financing options.

Also, the main burden on Europe's economy, the management of its peripheral and continuously spreading crises, is far from being resolved. This suggests that if Europe's private sector wants to see significant spending and growth in the coming year, it will need to secure capital from other parts of the world.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds