UK budget welcomed by private equity industry

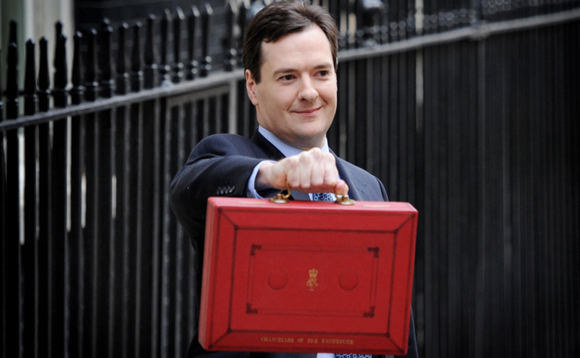

Hailed as тa budget for people who want to get onт by the government, and criticised by others for doing too little to pull Britain out of its economic quagmire, yesterdayтs statement will be intensely scrutinised in the days to come. unquoteт takes a look at what industry experts think about UK chancellor George Osborneтs fourth budget

While Britain's economic outlook appears dire, with growth of just 0.6% forecast for 2013 and deficit reduction set back two years behind the government's own target, UK businesses received a number of welcome tax changes and other incentives designed to boost growth.

The chancellor has moved to provide better incentives for employees to invest in businesses and offered capital gains tax relief for business owners selling to their employees. He also promised to increase the government's small business procurement fivefold. SMEs, meanwhile, will also benefit from exemptions to employer National Insurance contributions.

However, the headline business policy of the 2013 budget was a move to cut corporation tax further and in 2015 it will fall to 20%, which Osborne claims is the "lowest business tax rate of any major economy". Corporate tax rates will also be equalised, bringing simplification to the tax code, which many in the industry believe is sorely needed.

David Kaye, CEO of Puma Investments, believes the 20% rate will not have as big an impact as other measures. "The 20% corporation tax rate was widely expected and was already priced into the market," he says.

However, perhaps the most significant development for the private equity industry is a proposal to change the UK's limited partnership laws. While the move is unlikely to grab any headlines, a change to the laws that govern most private equity funds could provide a major boost to the industry and give private equity funds the ability to elect for legal personality. The BVCA said in a statement: "as [we] recommended, the Treasury is now committed to making changes to limited partnerships 'to more effectively accommodate their use for private equity investments'. [This] will advance the long-term prospects for the British economy."

Osborne also said it was important that people realise the UK's finance sector is made up of more than just banks and announced reforms intended to benefit the asset management industry more generally. Smith & Williamson's national tax director Richard Mannion said the changes will provide a boost to the UK investment sector: "The government is introducing a package to support the financial services sector, making the UK's fund management industry more competitive. This shows the government has recognised the importance to the UK economy of this sector and would also support them through a marketing campaign highlighting benefits of the UK regime."

The Investment Management Association hailed the changes as "the joined-up thinking and action that is needed to build on our asset management strengths and to develop a world class location for funds."

Help for SMEs was high up the agenda for Osborne and the budget announced a range of measures to boost this sector. First up, entrepreneurs will be buoyed by tax breaks for employee shareholders, as well as CGT exemptions for business owners selling to their staff. The government will also remove stamp duty for businesses selling into growth markets such as AIM, both of which will help businesses looking for succession. BVCA chief executive Mark Florman said he will "welcome the measures announced to boost the SEIS scheme, to offer CGT relief on employee share ownership, the abolition of stamp duty on shares traded on AIM and other growth markets".

Kaye says moves to eliminate employer National Insurance contributions for very small businesses will be particularly useful in promoting economic growth: "Small businesses provide a lot of employment and it's the reduction in the cost of employing people that will really boost the economy."

However, some groups have criticised the chancellor for not doing more. The British Chambers of Commerce (BCC) says many of the moves will benefit larger corporates, rather than small businesses, which most need assistance, and said a cut to business rates should have been implemented. "Many of the chancellor's measures are positive but may come too late, particularly for smaller and medium-sized companies. We need urgency, scale and delivery today," said BCC director general John Longworth.

While the industry has been broadly positive on the changes, some individuals might be less pleased with yesterday's statement. This includes Terra Firma boss Guy Hands, who is likely to be hit by moves to crack down on tax avoidance. Currently, Hands lives in Guernsey for tax reasons while his family reside in Kent. A change to the statutory residence test could mean that keeping interest and children in the UK would become a key consideration, potentially impacting his tax exile status.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds