VCT fundraising – a bumper year?

This yearтs ТЃ365m total fell short of some estimates for VCT fundraising activity. However the sum hides some very positive developments for the industry: namely a relaxation of investment rules, as well as a reinforcement of the delineation of the Best and the Rest. Susannah Birkwood reports

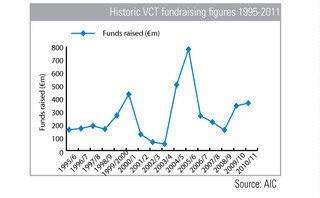

The £365m* raised by the VCT sector during the 2010-2011 tax year is a far cry from the £500m predicted by some industry insiders. Nevertheless, VCT managers are positive about these values, which still represent the fourth highest total since the vehicles were first launched in 1995.

But the underwhelming results were not universal. "Good VCTs with decent track records get the funds they are seeking," says Andrew Garside, manager of Baronsmead VCTs. "Funds raised by the generalists [the more traditional VCTs that invest in smaller-growing businesses] are up this year, which is an indication of investors' belief in the prospects of those VCTS and also of their track records, which have proved resilient through tough economic times. And it's not just about the total amount; it's whether the good managers have got enough to continue their investment operations."

The government's decision to reduce solar feed-in tariffs was one of the reasons the overall figures were more lacklustre than expected. Chancellor George Osborne's Budget speech intervention, stipulating that the feed-in-tariff for medium sized solar developments will be cut by a massive 72%, led to a significant reduction in the number of funds raised by the new solar energy VCTs. It is also called into question what will become of the specialist solar funds raised by the likes of Foresight Group in recent years.

A second factor which tempered these figures, according to Mark Wignall, CEO of Matrix Private Equity Partners, is the fear that the Chancellor would announce further adverse changes for the vehicles. "In fact, these changes did not emerge and the Budget was very positive for VCTs, but the uncertainty caused some advisers not to commit to the vehicles. Thus the usual late rush of money at the end of the tax year failed to materialise.

Change for the good

The good news is that this year's Budget proposals will effectively reverse European rules which have thus far limited VCTs' ability to channel their funds. The government has pledged to allow VCTs to finance a wider range of SMEs than is currently permitted, more specifically smaller businesses with up to 250 employees (up from a current limit of 50 employees) and gross assets of £15 million (up from the current limit of £7m). It will also increase from £2m to £10m the amount of investment which any one business can receive in a year.

"The specific changes that the Chancellor has targeted are all positive," says Garside. "There aren't too many, which is good as we needed a period of stability where shareholders and IFAs can get used to the rules. The step-up from 50 employees to 250 is really excellent news as it often occurs that a VCT-backed business qualifies for funding, but then grows and is no longer eligible. That proposal alone shows a really strong medium-term vote of confidence from the government."

Yet despite this optimism, projections are subdued for the 2011-12 fundraising calendar, not least because this year's Budget benefits could cause fundraisers to wait for their enforcement in 2012 before they raise their next VCT. The government's reintroduction of the carry forward rules on pension contributions may also constitute an important factor. This roll-over relief, which came in to full effect last week, allows pension savers take advantage of any unused contribution allowance in a future tax year - giving them less need for alternative forms of tax relief. "The ability of VCTs to raise funds is always affected by pension legislation, so I'd be surprised if the vehicles manage to raise more than £400m next year," says Wignall. "The leading private equity generalists - such as ourselves, ISIS, Albion and Northern - all had good raises of around £10-£15m or more this year though and will no doubt do similarly in 2011."

"Whatever the predictions, this has actually been a very good year, especially given that there's still some financial uncertainty around," Garside points out. "It wouldn't surprise me if next year is down on 2010, but that's not terribly important. The key thing is not how much is raised, but the vehicle's underlying performance."

* Statistics courtesy of the AIC.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds