Secondary buyouts on the rise

unquote” has recorded a significant hike in SBO activity in 2011 – indicating LPs’ fears over their comeback might not have been exaggerated after all. Greg Gille reports

Secondary buyouts are back in a big way, accounting for the majority of activity in Europe, and as much as two thirds of market value in the UK and France, according to unquote" research.

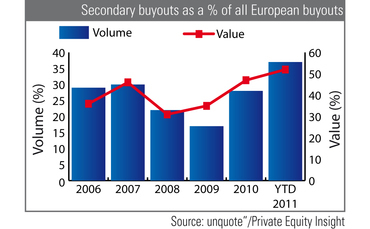

This marks a change from just last year, when LPs voiced concern over the perceived prominence of SBOs: proprietary research conducted at the end of 2010 showed that SBOs represented under a third of all buyouts by volume that year.

Market share was larger if measured by value, where SBOs represented nearly half, the highest value since 2007.

But 2011 sees this trend go even further: SBOs represented 52% of all deals in terms of value across Europe. This increase was particularly noticeable in the UK, where SBOs represented 65% of all buyouts value-wise, as opposed to 33% the previous year. Large SBOs of UK-based companies in 2011 include mobile phones distributor Phones4U (£630m) and environmental consultancy ERM ($950m).

The market share of SBOs in terms of volume is also the highest witnessed in years, with deals sourced from other GPs representing 37% of all buyouts. The Nordic and UK regions for instance have seen the proportion of SBOs in terms of volume rise from a quarter of all buyouts in 2010 to a third in 2011.

The phenomenon is even more pronounced in France: SBOs accounted for 62% all of buyouts so far in 2011, versus a third last year. Recent secondary transactions in France include engineering group SPIE (€2.1bn) and insurance company CEP (€850m), both sold by PAI partners to Clayton Dubilier & Rice and JC Flowers, respectively.

A number of factors could be contributing to the prominence of SBOs in today's buyout landscape. On the one hand, GPs eager to deploy capital will be on the lookout for easily-sourced, resilient businesses - which are more likely to already be in the hands of their competitors. On the other hand, PE firms in exit mode can be tempted to market their portfolio companies to other GPs, especially at a time when the IPO option still looks fragile and trade buyers appear to be paying lower multiples than GPs on average.

Despite research indicating that a deal sourced from another private equity investor doesn't automatically equate to lower returns, LPs generally have mixed feelings about SBOs. One could argue that most value-enhancing strategies will have already been implemented by the previous owner(s), leaving little room for operational value-creation - a trait likely to be even more prominent in "mega" SBOs. Time will tell if 2010-2011 vintages will put those concerns to rest.

Meanwhile, LPs will have to count on strategic buyers with excess cash on their balance sheets to boost trade sales as the year goes on. According to the latest Coller Capital Barometer, two thirds of a 110-strong LP sample expect trade sales to increase significantly over the next 12 months.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds