Continental drift: The mid-market squeeze

“There's a lot of interest in the £200-300m range, where the bigger ticket guys are coming down because they know they can spend some money, and the smaller ticket guys are stretching up,” says David Ascott, partner at Grant Thornton. Amy King reports

In the second instalment of our European buyout pulse checker, unquote" explores the emergence of a new trend for large-cap players dipping into the mid-market in search of dealflow.

Read our first instalment here.

The first half of the year has witnessed the emergence of a new trend: the squeeze into the mid-market, where some GPs have sought to sidestep upward pressure driven by the public markets.

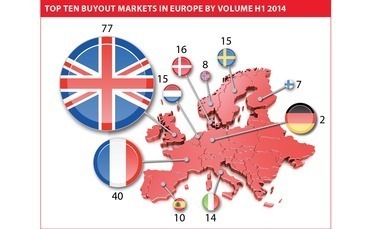

According to unquote" data, 88% of European buyouts occurred in the small and lower-mid market, defined as businesses valued at less than €250m, up from 81% in the previous half year. Appetite for deals in the space has been strong, particularly in the UK market, where 28 buyouts occurred in the mid-market in the first half of this year – just one deal fewer than the number recorded in the segment in H2 2013, which was the strongest six months across a five-year sample.

And the usual mid-market suspects have been flanked by some rather unusual players. On the back of a €925m fund close, Vitruvian Partners backed the £80m secondary buyout of JAC Travel from Bowmark Capital in June, having participated in a $66m series-D round for Farfetch in May. Furthermore, this year has seen KKR make a duo of investments via its existing balance sheet; one such deal saw the GP buying a majority stake in Aberdeen-based OEG Offshore Group in July, with investors in European IV Fund to be offered the opportunity to participate in the deal via the vehicle at a later date. Several industry practitioners have interpreted the structure as a means to incubate a smaller asset, growing it to the fund's usual target size – another example of larger GPs moving lower down the value chain. "We are incrementally seeing people doing deals that are surprising in size," says Christiian Marriott, partner at Equistone. "The chunkier deals that have equity cheques of £150m and upwards are investment bank processes, which involve looser credit because they are investment bank institutional debt and that is where the price inflation starts."

American pioneers

As is typically the case in private equity, a trail is being blazed in North America. The US market is home to several private equity behemoths that started out investing in smaller assets relative to their current average target. Due to their success, they were then able to raise larger funds and thus target larger deals. But in the post-crisis market, where appetite for mid-market deals is strong, these GPs have moved back towards their original, smaller focus and formalised this stealthy approach towards smaller assets with a new fundraise. Marlin Equity Partners' latest vehicle is a $400m lower-mid market fund, named Marlin Heritage Fund, which originally had an even more modest target of $250m. The fund was understood to be entirely subscribed by existing LPs; the GP's previous vehicle, Marlin Equity IV, closed on $1.6bn. In Europe, CVC's recently launched tech fund could be perceived as a reflection of this return to smaller fundraisings, with its $750m target.

Not only does this shift satisfy investor appetite for mid-market deals, but it could also solve a pan-European conundrum as a number of private equity veterans consider succession planning since rising private equity stars can be given responsibility for the smaller fund. "It is one of the ways you could satisfy investor interest in small- to medium-sized buyouts with your branding, but also provide a career path for some of the people who want to be managing general partners sooner rather than later. Watch this space; the model has worked very well in the US," says George Anson, managing director at HarbourVest Partners.

In the UK market at least, it appears space may be opening up for new players in the mid-market, following Gresham's announcement that it will not be raising another fund. This year has also witnessed a slowdown in investment pace at LDC, with 11 deals recorded in 2014 – down from 18 at the same point last year. The GP has traditionally driven the mid-market, taking home the title of most active investor in every year since 2009, according to unquote" data, only to be overtaken by Business Growth Fund this year. And with rumours of a much larger fund to be raised by Inflexion, average investment size seems a more fluid concept than ever in today's increasingly active buyout market.

As the dust settles across post-crisis Europe, GPs are holding back to see the lie of the land before committing the capital collected after an arduous fundraising. Though credit sources are ripe, public markets are open and capital is plentiful, assets large enough to make a dent in recently raised funds are scarce. Nevertheless, the second half of the year is unlikely to be quiet. Says Anson: "What we have been encouraging our GPs to do is keep searching for deals, but let us lighten the inventory. So many of them have been sitting on large portfolios of companies and holding periods have lengthened. GPs should take the opportunity to exit through an IPO or a trade sale while the window is there."

For more in-depth statistics on the European private equity market in Q2 2014, click here and download the latest unquote" Private Equity Barometer, published in association with SL Capital Partners.

Click here to read the results of our latest UK Watch survey, which polls local players on their expectations for the coming months.

LP perspective: Germany cools, Spain heats up

"I am quite pessimistic on Germany and the UK. I know the trends, but I would not be surprised if they reverse quite quickly, especially in the UK," says Ralf Gleisberg, partner at Akina. "What is going on in the UK is not sustainable in terms of political measures and the real estate market – that will disappear." Indeed, the rising number of exits in the UK would indicate that savvy GPs know their macro heydays are numbered.

Gleisberg is not alone in his negative outlook on Germany. Bruno Mory, investment director in private assets at Unigestion, voices a concern that has been haunting the local market for some time: "Germany remains disappointing. Dealflow is not that plentiful, given the size of the economy – traditional buyouts of the so-called Mittelstand companies are not really there." According to unquote" data the number of buyouts in Germany fell by 24% in H1 2014 compared to the previous half-year. "We are seeing more activity in terms of turnarounds or special situation deals rather than buyouts," says Mory.

While Germany – Europe's economic engine – may have fallen from grace, Spain is enjoying a reversal in its fortune. "Competition in the mid-market has increased significantly," says Mory, "and dealflow is promising; the deleveraging process by corporates and cajas is still running its course. We still believe it is the right time to invest and that the market is not yet overheated."

Nevertheless, competition for Spanish assets has heated up substantially, putting pricing under pressure. "If you ask which market looks most overheated, it has to be Spain," says HarbourVest's George Anson. A US-based private equity fund's bid to buy operating assets in Spain resulted in a final round that saw 15 bidders, 10 of which were New York-based hedge funds seeking to buy into the country's macro recovery, according to one industry professional. With less focus on buying the asset at an attractive valuation to drive operational efficiency than private equity bidders, the transatlantic bidders were able to make higher bids to take home the asset, pushing up pricing beyond the reach of competing GPs.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds