Private equity puts retail on the shopping list

Quite surprisingly, the retail sector has been generating significant interest from private equity as of late, indicating that this area of the market has the potential to return to its pre-credit crisis glory. Deborah Sterescu reports.

In recent days, the retail sector has seen its fair share of private equity, as investors are lining up to get in the game. Just today, news reports emerged that greeting cards retail chain Card Factory has received several takeover offers from the likes of Permira, Cinven, Summit Partners and Warburg Pincus for a potential £350m deal.

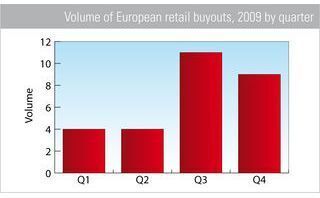

Statistical evidence backs this up, as according to unquote", the general retail sector in Europe saw a dramatic rise in activity in the last two quarters of 2009, with Q3 and Q4 recording 11 and nine buyout deals respectively, compared to four in the previous two quarters. Incidentally, one of the largest deals of 2010 thus far has also been for pet supplies retailer Pets at Home, which managed to secure £955m from buyout giant KKR and debt lenders Nomura, Calyon, Commerzbank and KKR itself.

These moves are somewhat surprising, as last year many steered clear of those businesses reliant on consumer spending. And rightfully so. However, some investors also believe that there is reason to avoid them in 2010 as well, said Peter Brooks of LDC London when speaking to unquote" late last year: "In terms of the best area to focus on, I would be wary of sectors that rely too much on personal consumption, as I think that disposable incomes will be hit by the rise in VAT and other tax rises likely in the 2010 budget. Cyclical sectors such as recruitment, capital goods and automotive will probably be among the better performing [in 2010]."

Interestingly enough though, this is not really the path all private equity firms have chosen to take. Reports this week also suggest that arts and crafts retailer Hobbycraft and Cath Kidston, the queen of floral prints, are attracting private equity buyers. Cath Kidston is said to be in talks with American buyout firm TA Associates in a deal that would value her company at £100m. These deals, however, are all with companies that have managed to defy the downturn, meaning that these businesses are prepared for even the worst of scenarios. Cath Kidston saw pre-tax profits grow by 61% to £4.6m in the year ending 29 March 2009. Sales as well surged to £31.3m during the same period, compared with £19.3m the previous year.

"There are differing views on the best time to invest in retail. My impression is that now should be a good time as most downturns see consumer spending leading the way to growth. This is in spite of the fact that consumers may be tightening their purse strings in the short term. The best investors will be able to balance the hard work required in the short term against the rewards further into the economic cycle," says Philip Sanderson, head of private equity at law firm Travers Smith.

Clearly, those investors interested in retail are not afraid of a challenge; here's hoping they succeed for the benefit of our economy.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds