Dealflow: Autumn boom expected after slow summer

As the summer holiday season draws to a close, Europeтs private equity market is set to pick up. While activity has slowed significantly in some regions, industry players are expecting a deal-doing boom in the coming weeks and months.

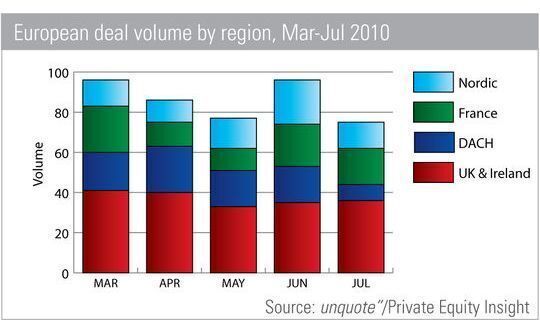

For those of us examining European deal activity, there has been a noticeable slowdown in recent months. While it is not surprising to see a lull in activity in the summer, improved dealflow in the early months of 2010 has made the lack of recent activity more obvious.

Germany has seen a major fall in private equity-backed investments in the summer months. While highly active in the spring, with 23 deals in March, volume fell sharply in July, with just eight transactions. Local market sources say this decline masks a major pipeline in deal activity.

According to Wilken von Hodenberg, spokesman for the management board at Germany's largest domestic buyout investor DBAG: "Buyout dealflow began to emerge rapidly during Q2, not just in terms of quantity, but also quality, and we are predicting a busy autumn for completions in the region."

The Nordic region, too, has seen a fall in activity in July, after a busy June. Deal volume peaked at 22 in June, before falling to 12 last month, and is set to be even lower in August. One leveraged finance professional in the region says deal activity is set to boom as the industry returns from its summer break, with a growing pool of debt helping to support future transaction volumes.

However, not all of Europe's markets have seen a decline. The UK, for example, saw deal volume hold up, falling only slightly between March and July. French deal activity also fared surprisingly well, after suffering a dip in activity in the early spring, with 18 deals in July.

While early 2010 has certainly seen an improvement on the difficult recession year of 2009, many believe deal activity is lagging behind the economy and will really take off in the autumn. Many of Europe's more northerly regions had a shorter-than-expected recession, and potential target companies have not yet had time to show improved earnings figures. With the economic picture becoming clearer, and debt availability said to be improving, private equity is set for a very busy autumn.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds