Venture Capital: A growing equity gap

Recessions are often looked back on as golden ages for the venture capital industry, as the next generation of successful and innovative businesses rise from the ashes of economic collapse. However, speaking to attendees of this yearтs Seedcamp last night, John Bakie found this recession may be more challenging for entrepreneurs than might be expected.

Earlier this year, Intel Capital's Arvind Sodhani told unquote" that times such as these present great opportunities for venture capitalists. As entrenched businesses struggle, those with new ideas and ways of operating can flourish. So, one would expect venture investors are eagerly hunting down the next big thing.

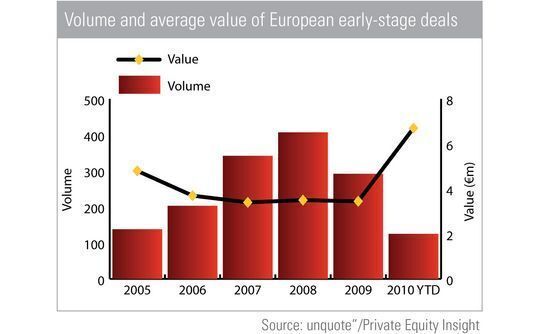

However, unquote" research shows that, not only is venture experiencing a continued decline, but is also seeing investment sizes moving up the chain, away from those businesses at the very earliest stages of development. Two thirds of the way into 2010, unquote" has recorded just 125 early-stage investments across Europe, well below the 292 seen in 2009. By comparison, growth capital and buyouts have seen a revival in 2010 after suffering immense difficulties last year.

The amount of capital being deployed in the early-stage segment has, however, not fallen at the same rate. This has pushed the average amount invested in European venture deals up to €6.7m so far this year. In previous years, average investment size has tended to vary between €3.5m and €4.5m.

This tallies with what some Seedcamp attendees had observed; venture capitalists are looking to later-stage businesses that are much closer to launching their product or service. Some felt those looking for series-A funding were not in the sights of venture capital funds.

It is, perhaps, too early to see if there is a longer-term trend for venture funds to move further up the development chain. However, one would expect early-stage businesses to be generating significant interest so soon after a major recession. If this trend continues, then Europe's venture market could lose out to the rapidly expanding US and Asian markets.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds