Deal in Focus: Endless acquires struggling Brabant Alucast

Endlessтs takeover of Dutch auto parts supplier Brabant Alucast International after years of debt woes marks the turnaround specialist's first foray into the Benelux region. JosУЉ Rojo reports

In February, turnaround specialist Endless bought Dutch car component manufacturer Brabant Alucast International (BAI) following a refinancing for the debt-ridden business.

Endless did not disclose the price paid to acquire BAI, but reports in the local press stated the GP will inject tens of millions into the business to help keep it afloat in the coming years. According to the firm, no job losses among the company's current 1,200 employees are expected following its takeover.

The deal comes a month after BAI struck an agreement with its lenders to refinance its existing senior facilities. Over the past four years, the business had operated at a loss and thus failed to meet its debt obligations.

Speaking to unquote", a source familiar with the situation explained that Endless first contemplated an acquisition in early January 2016. At the time, the GP became aware that Janivo, the investment holding of the Dutch Pont Brabant family, was looking for a buyer for a number of BAI subsidiaries.

However, a full takeover soon became a consideration in the ensuing talks between Endless and the sellers. BAI's previous lenders were invited to the talks and the company's existing debt facilities were renegotiated in the process, the same source added.

Reining in to stay afloat

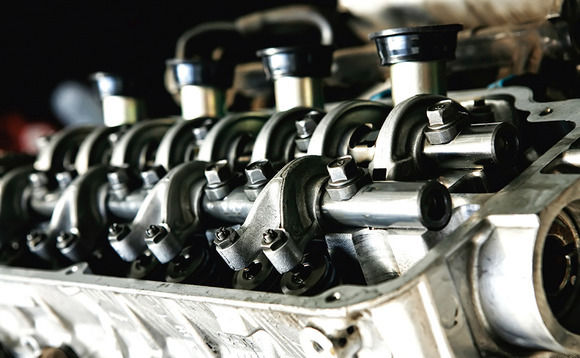

BAI has been producing high-pressure diecast aluminium and magnesium components for car makers since inception in 2007. Its flagship products Exactfit Casting and Vacurat Casting are manufactured at sites in the Netherlands, Germany, Italy and the Czech Republic. Headquartered in Oss, north of Eindhoven, the company employs 1,200 staff across these various locations. Its current sales figure lies around the €300m mark, unquote" understands.

In a recent interview, BAI CEO Marcel Schabos confirmed the company had narrowly avoided a bankruptcy scenario. The intercession of previous owner Janivo played a key role in renegotiating a deal with the lenders, Schabos said.

According to Schabos, who was named CEO of BAI in March 2015, the business had struggled to land new contracts among its client base in recent years. The executive attributed this to issues at the management level, leading to a slump in product quality and an overambitious expansion strategy.

According to the unquote" source, BAI had been crippled by a lack of investment for its expansion plans in the past few years. As a result, some of its subsidiaries were operating at a loss. The company and its shareholders now plan to bring all units back in the black. This will be accomplished by strengthening its current client base, featuring Audi, BMW, Ford, Porsche and Nissan, among other car makers.

Closer to home

As part of the changes, BAI has shut down its Chinese and Brazilian operations and will solely focus on its European business from now on. Over the next few years, the company expects to benefit from a renewed focus on emission-curbing programmes among car makers, which creates a need for lighter components.

The takeover of BAI represents the first Benelux foray for Endless and its second investment outside the UK. The deal is the seventh to be financed via its 2014-vintage £525m fourth fund; the vehicle has invested more than 25% of its capital to date, unquote" understands.

In addition, the deal is the first to be inked by the GP in 2016. As part of a recent unquote" profile of Endless, the firm was found to have significantly ramped up its investment efforts. Over the past 18 months, the investor has sealed 12 purchases, putting it very near the top of the UK's most active buyout houses, surpassed only by the traditionally busy LDC.

People

Endless – Garry Wilson (founding partner); Francesco Santinon (partner); Matthew Jubb (associate director); Simon Hardcastle (general counsel); Stefan Nowakowsky, Jon Duffy (investment executives).

Brabant Alucast International – Marcel Schabos (CEO).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds