In Profile: Marwyn Value Investors

UK-based Marwyn Value Investors is taking a different approach to the classic buyout by carrying out private equity deals from a public platform. Mikkel Stern-Peltz speaks to executive director Mark Watts about the innovative strategy

At its core, Marwyn's strategy is to find and back the strongest possible management team and provide it with a sector-specific buy-and-build platform. The way in which the firm does this in practice sets it apart from traditional buyout firms and goes some way towards bridging the gap between the public and private investment models.

"I am not saying our approach is better than that of private equity, it is just different. It is horses for courses, really," says Marwyn managing partner Mark Watts.

Marwyn's approach begins with identifying a sector where a structural shift is likely to occur that will add value, and provide a backdrop for consolidation. For the Haversham vehicle that acquired British Car Auctions (BCA) from Clayton Dubilier & Rice for £1.2bn in March, Marwyn backed former Stobart executive Avril Palmer-Baunack to lead a management team to find opportunities in the used-car sector.

Palmer-Baunack and Marwyn spent nearly a year performing due diligence on the sector and identifying opportunities before setting up the Haversham platform with her at the helm in late 2014.

Rather than keep the platform under a traditional private equity fund structure, Marwyn lists it on London's Alternative Investment Market (AIM) and capitalises the structure with cash raised from institutional investors and from its own evergreen vehicle, MVI, which takes a majority stake.

According to Watts, this structure shows vendors Marwyn means business – and is willing and able to put more capital to work. "We can go to a vendor and say ‘Aviva didn't come into this to invest £3m, they came in to invest £200m'," Watts offers as an example.

Invesco, Artemis, Schroders and Aviva were tapped to back Haversham, with MVI holding the majority stake. The six institutional investors in the vehicle committed £600m towards the acquisition of BCA, which allowed Marwyn to raise the balance of capital alongside the owners of BCA because there was no doubt about Haversham's commitment to buying the asset.

Marwyn will generally over-capitalise its buy-and-build vehicles off the bat, so there will be enough capital for smaller follow-on acquisitions after the first buyout. "We may do some equity raises later on but, usually, the first couple of acquisitions we do are off the balance sheet," says Watts, adding the amount of debt in the structure is relatively low to start with.

Flexible entry and exit

The alternative structure of Marwyn's vehicle also affords the GP a lot of flexibility in taking over private assets. In particular, it provides advantages in situations with multiple owners of a target who want different outcomes from a sale.

The public vehicle allows for acquisitions to be made with any combination of cash and shares, making it highly flexible. In buyouts of family owned assets, for example, the public model easily resolves a situation whereby one part of the family wants to exit and realise value, while another wants to remain with the company.

"The public structure is perfect for that type of deal because you can pay with a combination of cash and shares, and enable those who want to roll over and stay in to do that, while those who want to exit can take cash and walk away," says Watts.

"The beauty of the structure is that the person who then rolls over doesn't have to stay with the business for any significant length of time. They can take their money off the table at any time through the listed vehicle and, generally, they will get the listed price for the stock.

"That is very different from rolling your equity into a private equity structure where generally your opportunity to exit ahead of the private equity house would be pretty limited and, if you wanted to do it, you would probably have to sell out at a very significant discount in the secondary market," he says.

Marwyn's preferred platform also has some influence on the way the firm sources its deals. Like many private equity houses, Marwyn prefers to source proprietary deals. Watts says his firm generally tries to avoid typical private equity auctions processes, preferring instead to focus on deals where the GP's public model gives them an advantage over the typical industry structure.

While Marwyn's chosen investment model might see the firm miss out on the full spectrum of deals in the market, the firm argues it does offer a substantial upside when it is time to exit.

First, the structure allows for a company to be sold as a whole to a trade buyer or private equity house, but also eases the path to a full public listing. While a trade sale or secondary buyout of a Marwyn vehicle does not differ substantially from a typical private equity transaction, the path to an IPO does.

Watts says the problem with the existing IPO market is driven to a degree by multiple banks working on a single IPO and negotiating a price range back and forth between institutional investors and the owner. "It wastes a huge amount of time and money," he says. "Banks should be telling institutions what the owners want to sell the asset for, not optioning everyone at every stage of the process."

He says the current method has created distrust on both sides of the transaction, where private equity sees the market as unreliable and the public market sees private equity as greedy. "Our method disintermediates that to some degree and provides the security both sides crave."

The listed structure of Marwyn's vehicles and the fact institutional investors are already on board before an IPO allows for a much more streamlined valuation of the company and placement of shares ahead of an asset being listed, the firm argues.

Bottom line

Since its inception in 2000, Marwyn has invested £230m across 13 deals. For the GP and its investors, the unique investment approach has paid off: of the £2bn of co-invested capital in Marwyn's vehicles, the GP has managed a 25% IRR, while Marwyn's own LP fund investments have seen an IRR of around 19%. The discrepancy is due to the private equity house not always having the capital to follow assets all the way through its lifespan, as well as instances in which the GP has wanted an earlier exit than its co-investors.

As for what is next for Marwyn, the GP has raised £30m and set up a management team of former Virgin Media executives to head up the Zegona vehicle, to invest in a consolidating European telecoms, media and technology market.

The team

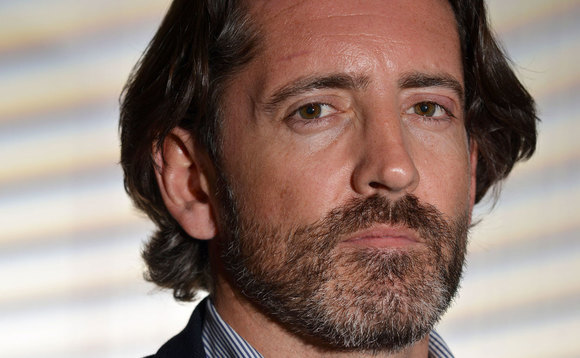

Mark Watts – executive director

Prior to Marwyn, Mark Watts worked for Matrix Strategic Research as a management consultant from 1995-1999 and, from 1999-2000, as a freelance consultant. In 2000, Watts and James Corsellis founded Marwyn. He is currently a managing partner of Marwyn Investment Management and Marwyn Capital.

James Corsellis – executive director

James Corsellis founded a strategic technology consultancy in 1994 and was CEO of provider of live auction trading platform icollector. Since co-founding the firm in 2000, he has been a managing partner of Marwyn Capital and Marwyn Investment Management alongside Mark Watts.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds