UK & France level on deal values as year ends

The UK and France look set to end the year neck-and-neck on deal value, while Germany has seen a major push in the venture space. With 2011 drawing to a close, how do Europeтs regions stack up? John Bakie investigates

With a swathe of mega-buyouts this year, much has been made of France's buoyant buyout market in 2011. The French market has been frequently compared to Europe's traditional private equity capital, the UK, as it attracted interest from major global buyout houses such as Clayton Dubilier & Rice and Advent International.

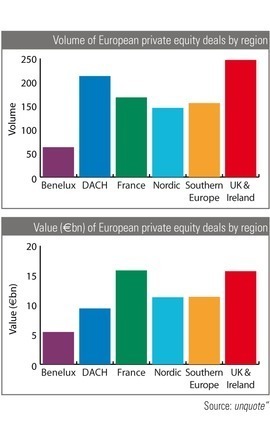

Figures from unquote's own data show the UK & Ireland and France are level on total deal value for the year, with France edging ahead on €15.85bn compared to the UK's €15.7bn. However, France is severely behind in deal volumes, back in third place after DACH and the UK & Ireland with just 168 deals across early-stage, expansion and buyouts. The UK & Ireland leads with 247 deals recorded, at the time of going to press.

Surprisingly, the DACH region has slipped into fifth place in terms of deal value, recording just €9.4bn worth of investment. However, despite the relatively low value of investments, the region saw the second largest deal volume in Europe, with 213 deals. This could be attributed to the relative strength of the venture sector in the region, particularly in Germany, which has seen significant activity, particularly in the technology and software sectors.

The Nordics and Southern Europe have kept pace with each other over the course of 2011. This might seem surprising considering the dire situation in the Eurozone, which has been particularly prevalent on countries in Southern Europe. However, a smattering of major deals by global players in both the Nordics and Southern Europe, coupled with continued activity in the lower and mid-market means total deal values for the two regions are separated by less than €100m. Southern Europe edges ahead in deal volume with 156 deals, compared to 146 in the Nordics.

The past year has brought a number of surprises. Not only in the sudden reversal of Europe's economic fortunes, but also in the way capital is being distributed. While the UK still leads it is no longer streets ahead of other parts of Europe for private equity investment. Equally, France may be finally opening up to the Anglo-Saxon model, enabling major global investors to take part in some of its major industries.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds