Venture: Aggressive investing needed in recession

Venture capital was, like other forms of investment, hit hard by the recession, with both volume and value falling during 2009. John Bakie speaks to Intel Capitalтs president, Arvind Sodhani, who says innovation does not stop for a recession, and believes an aggressive investment strategy in difficult times can reap rewards.

As one of the oldest corporate venture investors in the world, Intel Capital has considerable experience investing in all economic conditions. In the 20 years since it was founded, Intel Capital has invested more than $9bn in roughly 1,000 companies around the world. Backed by one of the world's biggest technology companies, it has continued to invest through the darkest days of global recession.

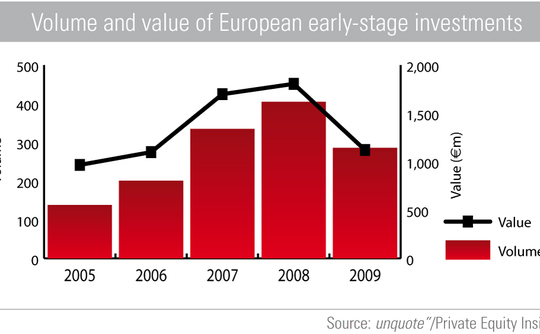

According to unquote" data, early-stage investment in Western Europe fell 38% between 2008 and 2009 to €1.12bn. Clearly investors were being increasingly cautious. However, Sodhani believes recession can be a great time for venture investors.

"Downturns produce opportunities for aggressive investors, and many of our best investments have been done in difficult economic circumstances," he says. As a corporate venture arm, Intel Capital is able to continue investing in times when independents might struggle. "We can hold companies for much longer and wait for an appropriate exit as we do not need as much liquidity [as an independent investor]," Sodhani explains.

Despite being different in many ways to traditional venture funds, Intel Capital remains concerned about the AIFM Directive and its potential impact on the European venture community. While much of the legislation does not affect corporate investors, Sodhani says it could have an impact on venture in Europe. "The ecosystem that supports entrepreneurialism is important, so if you put limits on some investors it affects us all."

The importance of ecosystems is demonstrated when investors enter developing countries. When Intel entered Vietnam, there were no other venture capitalists operating in the country, which meant there were few start ups in the country. "When you go into a new country without a venture ecosystem, you need to be patient and bring in support from lawyers and other investors to get things started."

Intel Capital continues to invest in technology start-ups across the world. Sodhani says innovation does not stop because the economy has stalled, and is not limited to specific geographies, meaning his team will continue to look at opportunities in every part of the world.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds