Trade sales on the rise

The partial sale of Alliance Boots to Walgreens by KKR and AXA PE is the latest in a series of exits propping up trade sale figures in 2012. Meanwhile the secondary buyouts trend is showing signs of abating. Greg Gille reports

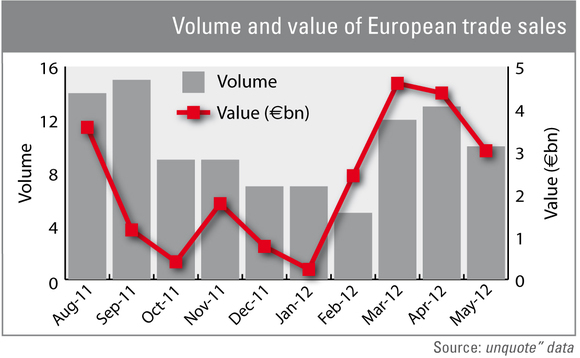

Following a five-month trough between October and February, European trade sale activity picked up in spectacular fashion in March, according to unquote" data: the volume of businesses sold by private equity houses to strategic buyers more than doubled between January and March, while the overall value of those deals increased by nearly 90%.

The uptick was confirmed in April (see chart above) before slowing down slightly in May – although figures for that month may yet increase as further deals are added to the unquote" database. Those activity levels may seem to suggest that trade buyers are returning to the healthy levels of M&A appetite witnessed in the first half of 2011, before lacklustre macroeconomic prospects took their toll. And despite worrying news still coming from Europe, US corporates in particular remain hungry for the largest PE-backed assets on the continent – as the Boots deal shows.

Notable trade sales this year include Cisco Systems buying NDS from Permira in March – a deal that valued the UK-based software business at around $5bn. Fellow heavy hitter CVC also made headlines in April by selling CEE-focused brewer StarBev to NYSE-listed Molson Coors for €2.65bn. In May, EQT sold Danish cancer diagnostics company Dako to NYSE-listed Agilent Technologies for DKK 12.8bn (c€1.7bn).

But some private equity houses have also looked east to find corporate buyers: Lion Capital notably sold 60% of UK cereal business Weetabix to Chinese food group Bright Food in a deal that valued the company at £1.2bn. This trend has been on the rise for some time now, with unquote" recording six sales of European private equity-backed businesses to trade buyers in emerging markets over the last 18 months.

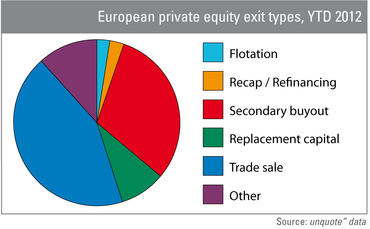

As a result of these improved activity levels, trade sales represent nearly 45% of all European exits so far in 2012 (see chart below). This is a notable improvement on last year's 37% and actually higher than the 42% witnessed over a 10-year period between 2000 and 2010 by unquote".

Meanwhile secondary buyouts, which accounted for a third of all exits in 2011, are so far making up for around 29% of European divestments this year. If sustained throughout 2012, this trend should be welcomed by those industry participants wary of the downsides of "pass-the-parcel" deals – that said, the proportion of SBOs in the overall exit landscape is still higher than the 25% average witnessed between 2000 and 2010.

To better serve all your private equity intelligence needs, unquote" has launched an improved version of its proprietary database: unquote" data Click for more information.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds