Investors shift focus on healthcare funding

Medical industries are often seen as a safe haven for investors in difficult times, proving to be robust and anti-cyclical as consumers cut down on luxuries to maintain spending on lifeтs essentials. But there are two very different stories in todayтs market. John Bakie investigates

This week saw the successful completion of one of the world's largest ever life science funding rounds. Worth an eye-watering $150m it dwarfs many buyouts of established and profitable companies. The US-based company, Valeritas, is producing a disposable insulin delivery device for patients with Type 2 diabetes.

The news suggests life science businesses are largely immune to the trials of the global economy, and life science and healthcare companies are often seen as being robust in the face of an economic downturn. While consumers are able to cut back spending on clothing, cars and electronics, they are somewhat more reluctant to make similar cuts to spending on their health. Governments are equally loath to make major cuts to healthcare funding for fear of a public backlash.

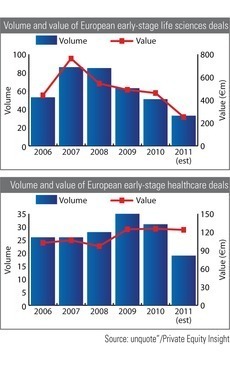

As the graphs below show, some impact was felt from the aftershocks of the financial crisis, but healthcare and life sciences were not as badly affected as many other sectors, and companies operating in these sectors could expect to continue receiving funding despite the generally poor investment environment.

However, interestingly unquote" data suggests that, while life sciences and biopharma investment has declined since the financial crisis, healthcare providers and services have seen an increase in investment, becoming a boom this year. So far this year, total investment in healthcare providers and services has already hit levels seen in 2009 and 2010 at €124m.

While substantial funding rounds for life sciences companies do still go ahead, many investors now believe the fundraising model is too risky, and are instead opting for companies who provide related services to obtain exposure to the health sector. Andrew Elder, partner at Albion Ventures, says "we look to back service providers active in healthcare, with good revenue streams and that are unlikely to fall within the scope of government cut-backs."

Funding major drug development projects can be an expensive and long-term undertaking for any investor, and carries the risk that any new drug will fail to pass clinical trials or may even simply not work at all. When given the choice between such high-risk activities and companies which already have a stable cashflow, it's easy to see why investors are approaching healthcare with caution.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds