Survitec deal bodes strong year for buyouts

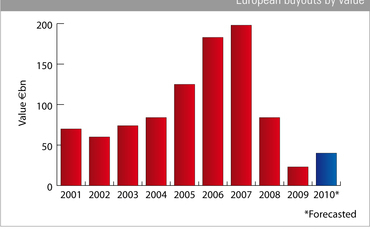

This week's foursome of sizable buyouts have put Europe on course to reach EUR 40bn for 2010, 50% larger than 2009's dire figure, writes Kimberly Romaine.

The total is a conservative estimate based on extrapolating the January monthly total, of nearly EUR 3bn, across the full year. However the total could be much higher since unquote" data suggests that historically January is the least active month for buyout activity in Europe, followed by August.

Preliminary figures for January 2010 reveal 19 buyouts worth EUR 2.9bn. The bulk of this came this week as four UK buyouts - ICG's CPA Global; KKR's Pets at Home; Advent's Xafinity; and Warburg Pincus' Survitec - indicated renewed signs of life in the asset class.

The month shows a marked increase on last January's paltry EUR 391m across 13 buyouts, as well as a healthy three-fold jump in average buyout size to more than EUR 90m this month.

Interestingly, secondary buyouts seem to be enjoying a renaissance of late, despite them being written off last year as a victim of the credit crunch.

This offloading of assets to other private equity firms could be an indication of the need for some buyout houses to return capital to LPs ahead of much-needed fundraisings, as exits were largely put on hold in favour of portfolio management in 2009.

The heftiest January since 2001 was 2007, when a staggering EUR 21.2bn was completed. Five mega-deals (EV 1bn+) made up more than half that total. The least busy was 2002 when 29 buyouts clocked up EUR 2bn.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds