2011 a bumper year for Nordic fundraising

Fundraising activity declined slightly in 2011 compared to the previous year, as the market remains tough and LPs selective. Not all European regions fared equally though, with the Nordic countries and France attracting significant amounts of capital. Greg Gille reports

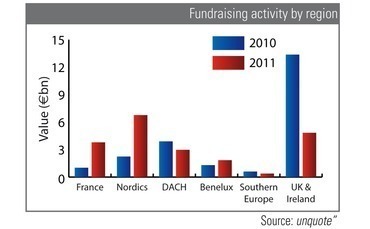

Despite a handful of large funds being raised, 2011 failed to match the previous year. unquote" recorded 46 vehicles reaching first or final closes for a total €20.6bn worth of commitments - just short of the €22.4bn across 56 funds in 2010 (excluding retail vehicles).

Year-end figures don't tell the whole story however - for the European fundraising landscape evolved noticeably between 2010 and 2011. UK-based GPs, for a start, failed to match a very successful 2010 that saw Clayton, Dubilier & Rice (CD&R), Pantheon and GSO raise multi-billion euro vehicles. By contrast, Montagu was the only player breaking the €1bn mark in 2011 with the final close of Montagu IV on €2.5bn. The overall number of funds raised by British players took a dive as well, with 10 vehicles closing compared to 19 in 2010.

Nordic GPs on the other hand enjoyed a particularly successful year, with Sweden attracting the most commitments in Europe. This is however largely thanks to EQT, which raised €4.75bn for its sixth fund - Europe's largest vehicle closed since 2008. Meanwhile, figures for Norway were boosted by HitecVision attracting $1.5bn for its latest fund. Overall fundraising activity in the Nordic region rose from €2.2bn in 2010 to €6.7bn last year.

France was on a bit of a roll as well with overall commitments jumping from €1bn to €3.8bn year-on-year - although, unlike in the Nordics, this can be attributed to a string of fundraises in the mid-cap space rather than a single standout vehicle. Astorg Partners closed the largest French fund of the year with its fifth effort, raising €1.05bn just six months after launch. The remaining bulk of capital raised came courtesy of Apax France and Chequers Capital, closing Apax France VIII on €700m and Chequers Capital XVI on €850m respectively.

Fundraising activity heated up in Germany as well. While the country was home to only three closes in 2010, this figure increased nearly three-fold last year with overall commitments growing from €696m to €1.5bn. High-Tech Gründerfonds notably closed its High-Tech Gründerfonds II fund on €288.5m, and DBAG's Expansion Capital Fund closed on €242m.

As a result of these evolutions, the contribution of each region to the European fundraising landscape changed noticeably between 2010 and 2011. The UK dominated the scene in 2010, making up for a whopping 59% of fundraising activity in value - this figure dropped to 23% last year, with France closing the gap (18% against 5% in 2010). Meanwhile the Nordic countries attracted a third of all commitments in 2011. This is a significant step-up from 2010, when fundraises by Nordic GPs accounted for just 10% of the overall capital raised in Europe.

Although 2011 will be remembered as a strong year for Nordic fundraising, it remains to be seen whether future dealflow in the region will keep up with the large amounts of dry powder building up.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds