LPs speak out on private equity communications

In a recent study undertaken by IE consulting, 60 Limited Partners from across the globe were invited to share their thoughts on the effects of the financial crisis on their private equity investing and to rate how well their private equity fund managers had been communicating with them.

Whilst the survey found that GPs had been, on the whole, happy to provide additional information when requested by LPs, many LPs said that they had refused to re-up with a GP solely owing to poor communications from the GP.

Matthew Craig-Greene, Managing Principal of IE Consulting said "Although General Partners seem to have finally understood that they must become much more sophisticated in the way that they deal with their investors, it is clear that their remain quite some way to go".

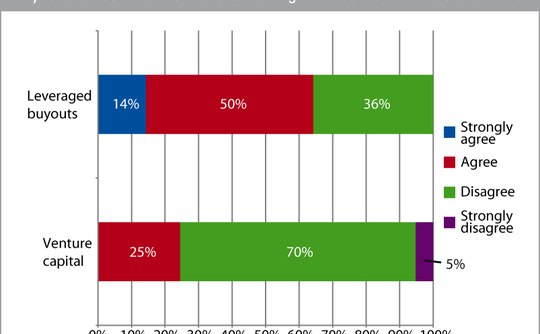

Now that the dust has begun to settle, the survey found that LPs had become more distrustful of the leveraged buyout model, but that their attitudes towards venture capital investing had not changed.

Craig-Greene commented "This does not mean that we are on the brink of another venture boom or, for that matter, that the end of the LBO is nigh: The perception of VC amongst many LPs is poor to begin with, so there might not be much further for it to fall and the best performing GPs will still manage to raise sizeable buyout funds".

The summary report is available for download [asset_library_tag 1263,here].

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds