PE-backed IPO activity failed to ignite in Q1

unquote” data confirms that Q1 was one of the quietest first quarters on record in terms of European PE-backed IPO activity – but a number of upcoming listings on the continent should help liven up Q2 figures. Greg Gille reports

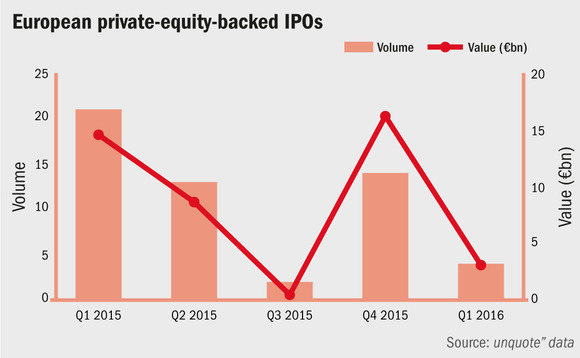

A flurry of listings at the end of 2015 could have hinted at a PE-backed IPO revival across Europe following a slump in Q3. Judging by figures for the first quarter of 2016, these hopes were short-lived. According to unquote" data, Europe was home to four listings of PE-backed companies in Q1, down from 14 in the previous quarter and well short of the 21 IPOs recorded over the same period last year.

As far as first-quarter activity goes, Q1 2016 will go down as one of the quietest periods in quite some time; the first three months of 2014, when the European IPO revival was just picking up pace, saw 18 listings taking place while the much more sedate Q1 2013 still witnessed eight IPOs.

Exit stage right

Predictably, other exit routes proved much more popular in Q1 this year. IPOs only accounted for 2% of PE exit activity volume-wise in the first quarter, against 6% in the whole of 2015 and 7% in Q1 last year. With several dual-track processes eventually going the way of secondary buyouts or trade sales, these two exit routes unsurprisingly accounted for 40% and 34% of divestments in Q1 2016, respectively – a trend predicted by our panel of industry experts at the end of 2015. KKR's sale of French clothing retail group SMCP to China's Shandong Ruyi Technology Group at the end of March neatly illustrated this trend.

That is not to say the first quarter did not witness notable listings though, with the aggregate market cap of Q1 IPOs exceeding €3bn. British building company Countryside, backed by Oaktree, listed on the London Stock Exchange with a market cap of £1.01bn in mid-February. Oaktree and members of Countryside's management team sold shares in the offering, receiving £174m from the sale.

Still in the UK, Apax Partners-owned Ascential, part of the Guardian Media Group (GMG), was valued at £800m in its IPO on the London Stock Exchange in February. Over in Germany, Centerbridge Partners' wind turbine maker Senvion listed on the Frankfurt Stock Exchange at €15.75 per share, netting its backers proceeds of €300m. Senvion illustrates the rocky nature of flotations in the current environment though, a major factor behind Q1's lacklustre figures: after making its flotation plans official and setting the price range at €20-23.5 at the beginning of March, the company cancelled its private placement on 16 March due to "market volatility", before a final change of heart.

Continental hopes

Fortunately, the pipeline appears to have filled up somewhat in recent weeks, with a handful of notable PE-backed IPOs pencilled in for Q2 and beyond across continental Europe. Nordic Capital, for instance, intends to contribute its fair share: its Finnish discount retailer Tokmanni recently announced its intention to float on the Helsinki stock exchange within the quarter, four years after the SBO backed by Nordic Capital VII. The GP could also be making a partial exit from Swedish consumer finance business Resurs, which published an intention to float on the Nasdaq OMX Stockholm stock exchange before the end of June.

Spain could also see its first IPOs of the year before the end of Q2, as Arle's Parques Reunidos and Telepizza – backed by KKR and Permira – announced their intentions to float on local stock exchanges in May 2016. These two listings could be a bellwether of investor appetite for large-cap listings, with Parques Reunidos and Telepizza understood to be eyeing valuations of €2bn and €1.2bn respectively.

The pipeline looks quieter in the UK though, despite US-based private equity firm Lone Star's plans to float brick manufacturer Forterra on the LSE in April, aiming for a £450m valuation. The mounting uncertainty over a risk of Brexit, which also significantly hampered investor confidence on both the buy- and sell-sides in the first quarter with lacklustre deal-making activity, loomed large over IPO prospects in Q1 and should continue to do so as the country gets nearer to its potentially game-changing referendum in June.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds