Opinion: Is security software becoming more attractive to private equity?

Private equity investment in UK security software companies has been subdued despite explosive growth in the cybersecurity market. Emmet Keating of Catalyst Corporate Finance explores why buyout houses have overlooked this sub-sector

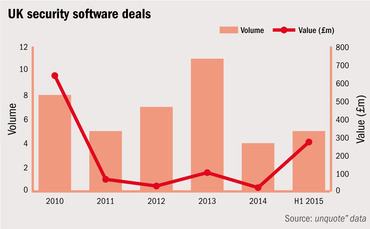

In recent years, private equity investment in the UK security software market has been relatively scarce with only a handful of transactions per annum (see Figure 1 below).

Figure 1

This is somewhat surprising given the heat in the cybersecurity sector in general, a niche that is continually reinforced within the UK technology press as one of the key drivers of growth in the wider IT sector.

As you would expect, the buzz in the sector is mirrored across the pond. Our US-based TMT sector colleagues recently noted the following key points from Black Hat USA 2015 (a cybersecurity show held in August in Las Vegas):

- IT security is a creative sector with significant investment in R&D, leading to emerging detection and counter-hacking technologies

- Breaches are continuing unabated despite a plethora of innovative solutions and new approaches

- CTOs at large corporates face a challenging task of sorting through the hype to embrace and implement cost effective solutions

- Capital markets have been active in the sector, with even early-stage companies demonstrating the ability to raise substantial capital at attractive valuations

- Barack Obama's latest budget proposal for 2016 seeks $14bn for cybersecurity efforts across the US government to better protect from hacking threats

- M&A transactions in the sector are currently experiencing high trading multiples and some retrenchment is expected within 18-24 months. This rationalisation will encourage more strategic M&A activity as buyers, sellers and investors find more common ground upon which deals can be agreed

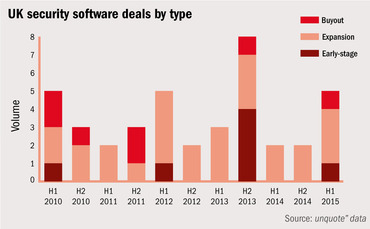

Back in the UK, small, emerging high-growth sector participants are characterised by relatively low EBIT margins, making this niche more attractive to venture capital firms than mainstream UK private equity. This is reflected in Figure 2 below, showing around 65% of recent UK security software deals being expansion investments, rather than pure-play private-equity-backed management buyouts.

Figure 2

One consideration is that businesses enjoying more than 20% annual revenue growth tend to be valued on an EV/revenue multiple rather than the EV/EBITDA metric with which the buyout investment model is most comfortable.

However, success stories at the larger end of the market, such as Vista's recent $1.9bn exit from Websense and the £1bn IPO of Apax-backed Sophos at 25x EBITDA, will feed through to mid-market PE houses keen to invest capital.

Smaller UK players such as Becrypt, Intercede, Clearswift and Bullguard among others can benefit from this source of funding; indeed, Clearswift and Bullguard are already backed by Lyceum Capital and DFJ ePlanet Ventures.

From a private equity investment perspective, the IT security market environment is conducive to fast growth and faces an increasingly broad range of exit routes.

Cheats never prosper

There has been a spate of recent IT security breaches at large corporates, most notoriously the recent data hack of US extra-marital dating platform Ashley Madison. Ever-increasing use of mobile and cloud technology is opening up unprecedented vulnerabilities within organisations, and so IT application vendors are seeking to enhance security features of their software.

Microsoft is one example of a large trade acquirer that is keen to snap up promising IT security businesses, having made three such acquisitions this year already – Adallom, Aorato and Equivio. Cybersecurity businesses are generally well valued on public markets at the moment, so listing on AIM or the LSE is an option for promising companies in the sector.

And as the conversations we are having with financial investors and emerging businesses in the security software space confirm, the current M&A environment is presenting rich opportunities.

Emmet Keating is a director at Catalyst Corporate Finance.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds