Secondary buyout levels reach new heights

More than four out of every 10 buyouts were sourced from other GPs in the first nine months to September this year, according to the unquote” proprietary database, marking the highest level recorded. Vidur Sachdeva reports

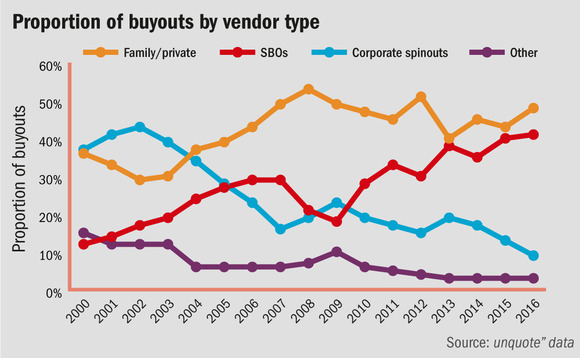

The post-financial-crisis period has witnessed secondary buyouts (SBO) continue to emerge as an important part of the private equity industry model. The latest analysis from unquote" data has revealed that Europe was home to 479 buyouts worth €78.4bn in the first three quarters of 2016. Of these, 194 deals were SBOs, valued collectively at €39.3bn, accounting for 41% of buyout volume and half of buyout value in Europe. This marks the steady and significant growth of the European SBO market as these transactions accounted for a mere 18% and 31.9% of buyout volume and value respectively in 2009.

The analysis also reveals that SBOs have become larger in size during this period. In 2016, the average SBO was valued at €202.4m, representing a rise of 23% from the €164.5m noted in 2009. Indeed, this has been largely due to the increase in the number of €1bn+ transactions in the segment: the first three quarters of 2009 saw just one such buyout, while 2016 has witnessed four.

The rise in popularity for the SBO segment coincided with a steep decline in the corporate spinout segment. At the start of the eight-year period in 2009, local and foreign parents together outpaced SBOs, accounting for 23% of all buyouts in Europe. By the end of the third quarter of 2016, the segment accounted for just 9% of the dealflow. At the same time, family or private vendors remained relatively stable at 48%, marking a marginal decline of 1%.

If these trends continue to extend with the same momentum that we have witnessed since the unfolding of the financial crisis, one can foresee SBOs comfortably overtaking all other vendor types and emerge as the single-most popular exit route within the next five-years or so.

The following are five of the largest SBOs of 2016 to date:

5. Polyconcept – $975m (est); August 2016

Boston-based private equity firm Charlesbank Capital Partners acquired specialised retailer Polyconcept from Investcorp, the company's majority shareholder since 2005. Investcorp fully exited the company, the GP confirmed. The deal also marked the exit of 3i, which co-invested alongside Investcorp in 2005, acquiring a minority stake in the group. 3i said its proceeds from the sale would amount to around £45m. Equity for the transaction was provided by Charlesbank, management, Partners Group and additional investors. Charlesbank said it would partner with the management team to expand the business globally and build on Investcorp's investment strategy, as well as tap new growth opportunities.

4. Polynt and Reichhold – €1bn (est); May 2016

Investindustrial-backed Italian resins producer Polynt and US-based competitor Reichhold, backed by Black Diamond Capital Management, merged, creating a speciality chemicals group. The group would generate a combined turnover of €2.1bn with €200m of EBITDA and have 45 facilities across North and South America, Europe and Asia, employing 2,500 people. As part of the deal, Investindustrial and Black Diamond invested in the new group and retain an equal stake, representing a combined majority share in the business. GSO Capital Partners provided debt financing to support the transaction. According to unquote" sister publication Debtwire, the debt facility consisted of a €625m unitranche.

3. Sisal – €1bn; June 2016

Private equity firm CVC Capital Partners wholly acquired Italian gaming and payments operator Sisal for €1bn from Permira, Apax Partners and Clessidra Capital Partners. Permira sold its 20% stake in the business, while Apax and Clessidra each reportedly divested a 36.5% stake. Morgan Stanley, Credit Suisse and Unicredit provided debt financing to support the transaction. The firm stated it intends to use the capital injection to boost its expansion in several market areas, including payment services, and bolster its online gaming and betting platform.

2. Sitecore – €1bn; April 2016

Another notable SBO was EQT's acquisition of Danish content management software developer Sitecore in a deal valuing the company at €1bn. The GP tapped its €6.75bn EQT VII fund for the equity, with Danish pension funds Danica and Sampension providing additional equity as co-investors. EQT took a majority stake in the company, with Sitecore's founders retaining a significant minority stake. The deal provided an exit for Technology Crossover Ventures, a Palo Alto-based venture outfit that took a large minority stake in Sitecore in December 2011. As a result of EQT's buyout, the Danish company joined the ranks of Nordic "EUnicorns" – tech companies with a valuation in excess of $1bn based in Europe.

1. Foncia Groupe – €1.8bn; June 2016

The largest SBO in Europe was the €1.8bn sale of French real estate group Foncia by Bridgepoint and Eurazeo to Partners Group. It is understood that the deal was expected to bring exiting shareholders a 2.4x return on their original investment. Net proceeds after tax, transaction costs and acquisition debt repayment amounted to around €1.1bn. Since their investment in 2011, Foncia's annual revenues grew by 4.4% and its average annual EBITDA by 11.3%. Overall, the group's EBITDA increased by 50%, from €86m in 2011 to €132m in 2015.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds