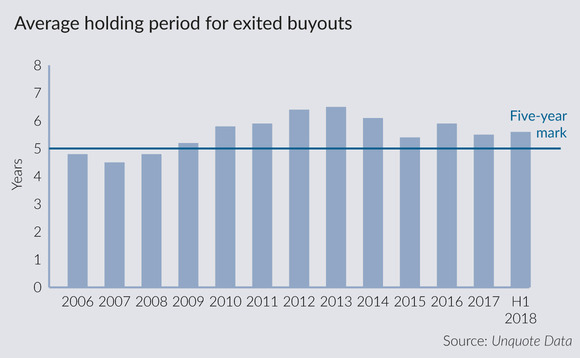

Average holding period stays high as quick exits lag

The average holding period in European private equity remained above the five-year mark in the first half of 2018, according to Unquote Data.

European buyout investments that were fully exited in the first half of the year had been held for an average of 5.6 years, roughly the same figure seen in 2017 (5.5 years). Holding periods have settled at a new normal average of around 5.5-6 years, above the pre-crisis normal of around 4.5-5 years.

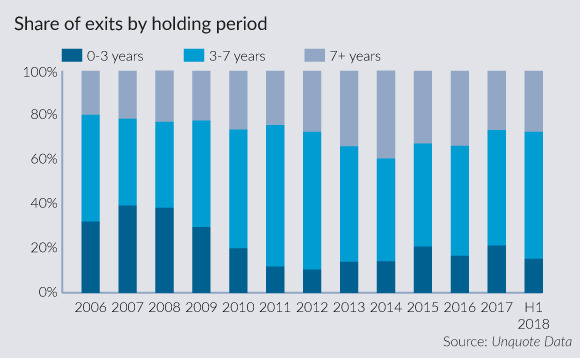

Breaking holding periods down into short, medium and long holds reveals that rising average holding periods are being fuelled by a substantial decline in short holds and slightly more longer holds.

Short holds – buyouts exited within the first three years – accounted for 15.3% of exits in the first half of 2018; this percentage has remained in the 10s and low-20s in recent years. This compares with far higher pre-crisis rates well above 30%.

Long holds – buyouts exited after seven years – accounted for 28% of exited buyouts in the first half of 2018, a far cry from 2014's 40% but still higher than pre-crisis rates of around 20%.

There was a sharp dip in short holds in 2011 and 2012, as asset prices were subdued and dealflow dropped in 2009. Pre-crisis investments were eventually offloaded between 2013-2016, which is reflected in the elevated proportion of long holds.

Unquote recently reported a growing popularity of single-asset funds that use secondary capital to keep a portfolio company under a GP's management after the original fund has run its course. It allows promising assets to be developed beyond typical holding periods.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds