UK lower mid-market resilient in 2012

While activity in the тЌ50-250m segment has failed to improve on 2011 figures on a pan-European level, the UK is proving to be fertile ground for deal-making in an otherwise troubled macroeconomic environment.

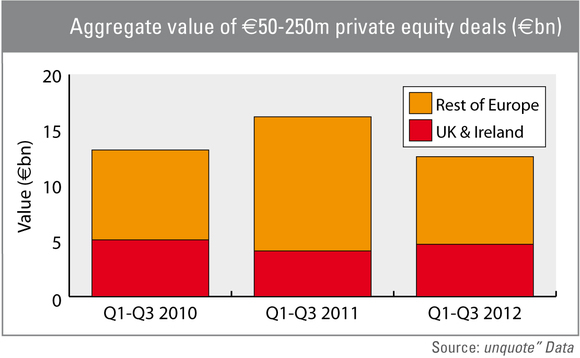

One could think that the lower mid-market segment would be reasonably sheltered from some of the factors affecting larger transactions, such as sizable financing being tougher to arrange. But the low-growth environment is also taking its toll on buyouts valued in the €50-250m range. According to unquote" data, such deals amounted to an overall €12.6bn across Europe in the first nine months of 2012 – this is down by nearly 23% on the €16.2bn recorded over the same period last year. Volume-wise, the drop is also significant at 107 deals, down 29% on the first three quarters of 2011.

Although pan-European figures are alarming, the UK seems to have been following opposite trends. Last year was somewhat disappointing – lower mid-cap activity declined by a fifth in Great Britain while it increased significantly in Europe as a whole. But 2012 is shaping up well: UK deals in the €50-250m range are up by 15% in value and virtually stable in volume compared to the same period in 2011.

Unsurprisingly, mid-cap specialist LDC has been busy this year, completing three deals worth an estimated aggregate of nearly €300m. It notably backed a £112m management buyout merging recruitment services providers Pertemps and Network Group in February, and bought gas pumps manufacturer Bifold Group from Caird Capital for £85m in April.

Meanwhile Montagu has also been active at the upper end of the deal bracket. The GP started the year by buying the legal education and training business of The College of Law for an estimated £200m. It then acquired Leeds-based CAP, a provider of information to the automotive industry, for an estimated £175m in May.

While UK activity figures are encouraging, they mainly rest on the back of a strong first quarter. Q3 deal activity in particular was nearly halved compared to Q1, suggesting that the UK is not totally immune from the glum mood currently prevailing on the continent.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds