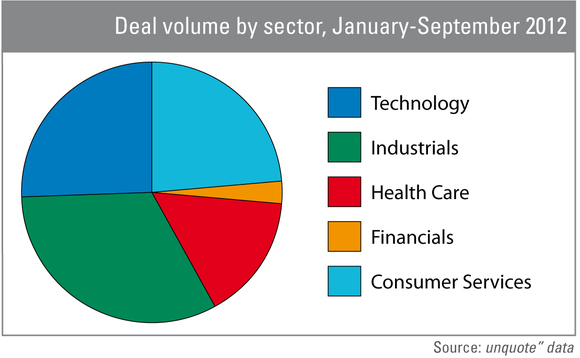

Industrials and consumer see most volume in 2012 to date

The industrial and consumer sectors outperformed other major industries in terms of deal volume between January and September 2012.

Industrials includes business support services, which have provided a consistent source of deal flow throughout the year. Economic uncertainty has pushed companies to consider options for vertical integration, which often includes support services, such as data providers and managers.

Expectations for 2013 are for continued slow growth and, as such, it is likely that private equity funds will continue to actively manage their portfolios and employ buy-and-build strategies wherever possible. The share of deals in the industrial sector has fallen by 3.5% since the same period (Q1-Q3) in 2011, but it still leads with the highest deal volume.

Consumer services deals increased from 21% to 27% since the same time period last year, with most activity in the subsectors of specialized consumer services and speciality retailers.

Previously popular safe-haven sectors like healthcare and technology have seen less deal actvity since the summer. The share of healthcare deals were 3% higher last year.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds