Private equity still greedy for restaurants & bars sector

The buyout of Côte Restaurant by CBPE adds to an already busy year for investments in the eating and drinking sector, with activity recorded so far in 2013 already exceeding that of the whole of last year.

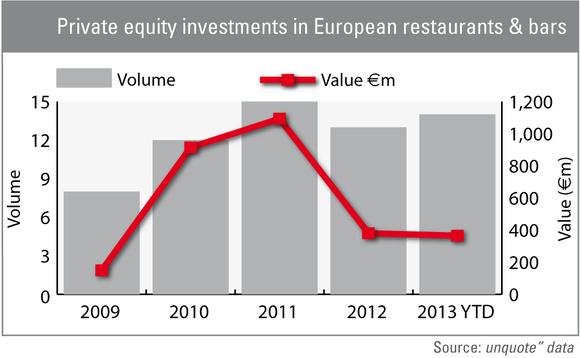

unquote" has already recorded 14 transactions in the restaurants & bars sector across Europe so far this year. With more than three months still left in the year, this figure has already exceeded dealflow recorded for the whole of 2012, when the sector was home to 13 transactions Europe-wide.

Value-wise, year-end figures should have no trouble matching and more likely exceeding 2012 levels either: the deals recorded so far in 2013 are worth a collective €365m, almost on par with the €380m deployed in the whole of last year.

The UK's wining and dining scene has proved particularly attractive, as evidenced by the hype and competition surrounding the Côte auction. CBPE clinched the French bistro-style restaurant chain earlier this week, outgunning rivals thought to have included Bridgepoint, LDC, Equistone and TA Associates. It is worth noting, however, that the business is believed to have fetched a price tag of less than £100m, when earlier estimates were closer to the £120m mark.

Still in the UK's upscale "steak and chips" segment, Graphite Capital acquired Hawksmoor in a management buyout in July. It is believed the deal was valued at between £35-40m. Debt for the transaction was provided by Lloyds Bank Commercial Banking Acquisition Finance.

Although traditionally thought of as the home of fine cuisine, France saw more activity at the casual end of the market. Just this week, BPI France, Midi Capital and Multicroissance invested €4.6m in American-style restaurant chain Tommy's Diner. Other French deals completed in recent months included roadside grill house chain Courtepaille, fast food specialist Quick Restaurants and sandwiches-focused Class'Croute.

All data is sourced from unquote" data, the unquote" proprietary database. To conduct your own searches on pan-European private equity trends, visit unquotedata.com

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds