Europe-wide PE investment to fall below €45bn in 2012

Following a lacklustre start to 2012, Europe should see year-end buyout investment levels barely hit the €40bn mark – the first glitch in an otherwise steady recovery since 2010. Greg Gille reports

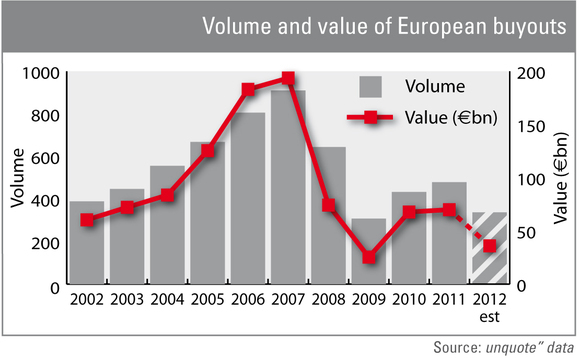

Figures for the first five months of 2012 paint a sobering picture of European buyout activity: unquote" recorded only 141 transactions worth a combined €14.9bn. This is less than half of the amount invested value-wise over the same period last year, and even some way off the €17bn invested across 148 deals in 2010.

Dealflow has certainly slowed down compared to the first five months of 2011, when unquote" recorded 226 buyouts completed across Europe. This is not the only explanation for the drop in the overall value of transactions though: the average deal value stands at €104m so far in 2012, against €148m between January and May 2011, indicating that larger deals remain few and far between.

Looking back over the past decade, statistics from unquote" data indicate that European buyouts completed in the first five months of the year account for on average 38% and 34% of the yearly volume and value totals respectively. Extrapolating from these figures indicates that 2012 year-end buyout activity levels will amount to around 370 deals worth a combined €44bn.

As with any forecast, myriad variables may mean the year ends higher – or lower. For example, in 2009, activity picked up spectacularly as the year went on following an abysmal first half: the last seven months of 2009 accounted for a whopping 84% of the year-end value total. By contrast, last year's dealflow declined sharply after the summer following a strong first half as the eurozone crisis worsened.

These two scenarios paint very different pictures: the former could see the overall value of European buyouts potentially break the €80bn mark, while a 2011-like outlook would hint at a €30bn total. A dramatic recovery in the second half of 2012 is unlikely though. Only a string of mega-buyouts – or at the very least a strong upper mid-market run – in the coming months could significantly boost year-end figures, but the current macroeconomic environment is not particularly conducive to either scenario.

One thing is for sure: if dealflow was to stay on par for the rest of the year, European buyout activity would struggle to exceed 350 transactions, and the overall amounts invested would barely break the €35bn mark – making it the second worst year in a decade for private equity activity after 2009.

To better serve all your private equity intelligence needs, unquote" has launched an improved version of its proprietary database: unquote" data Click for more information.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds