UK activity falls behind France and DACH

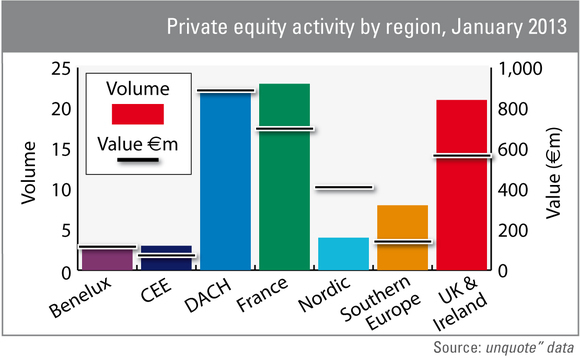

The UK & Ireland private equity market has been overtaken by the French and DACH regions in January according to figures from unquoteт data.

The UK – traditionally the strongest market in Europe and leading the pack by a significant margin in 2012 – has gotten off to a relatively weak start in the New Year.

Research from unquote" data shows there were 21 deals recorded in the UK in January, worth a combined total of €568.9m. By comparison, France saw 23 deals for €702m, while the DACH region registered 22 transactions valued at €890.7m.

France's strong performance in January will be encouraging for the market after a particularly disappointing 2012, which was tainted by political and economic upheaval. While there were no exceptionally large deals, the French mid-market showed consistent activity in January 2013, an encouraging indicator. The largest deal was the €119m buyout of clothing brands Cyrillus and Vertbaudet by Alpha Associés Conseil.

The large value of deals seen in DACH was largely driven by a single large transaction in Switzerland, the €416m buyout of chemicals company Clariant's textiles, paper and coatings operations. US-based investor SK Capital acquired the businesses from their listed parent company.

Germany saw 17 deals worth €301m, indicating that the country is relatively active, though the bulk of investments were early-stage and growth capital deals, with relatively few buyouts, resulting in the lower overall market value.

The Nordic countries, while seeing much lower levels of deal activity than the larger regions, continued to punch above their weight with the largest average deal value among the regions. Its four transactions were worth a total of €412.9m, giving an average deal value of €103.2m. The largest Nordic deal was thought to be the buyout of Beerenberg Corp by Segulah. The company, which provides services for the Norwegian oil and gas industry, is thought to be worth more than €150m.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds