Germany shifts into overdrive in Q2

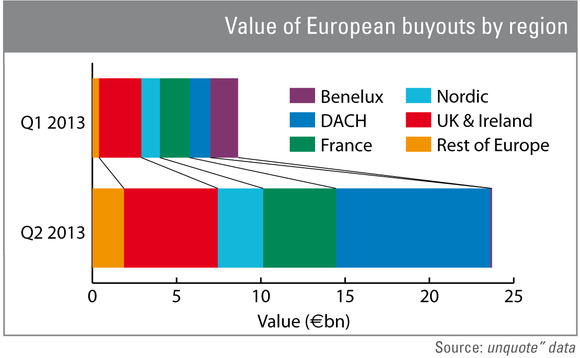

A string of mega-buyouts helped Germany secure the top spot on European buyout value tables in the second quarter of this year.

For the first time in three quarters, the UK was not the largest regional market in value terms, despite the collective total more than doubling from €2.5bn to €5.6bn. It did, however, remain the pre-eminent market in volume terms after jumping by close to 30% from 27 deals to 35. Taking top spot in aggregated investment was the DACH region, which saw its value total balloon from €1.2bn to €9.2bn after hosting the three largest Q2 deals. These acquisitions alone – Springer Science, Ista International and Ceramtec – were worth an overall €7.9bn.

Although the German uptick was the most impressive, the increase in buyout values over the second quarter was noticeable across most European regions. The aforementioned two-fold increase in the UK was matched by the Nordic region (from €1bn to €2.7bn) and France (from €1.7bn to €4.3bn). Southern Europe also impressed with a four-fold increase from €394m in Q1 to €1.8bn in Q2.

These impressive value increases were not matched by an equal uptick in dealflow, though: click here to view full Q2 buyout figures in the unquote" Private Equity Barometer, sponsored by SL Capital.

All data is sourced from unquote" data, the unquote" proprietary database. To conduct your own searches on pan-European private equity trends, visit unquotedata.com

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds