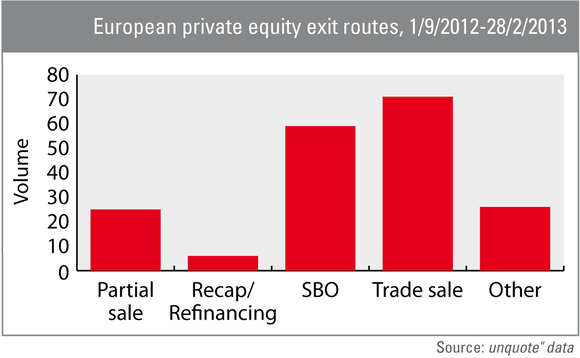

Gap narrows between trade sales and SBOs

Trade sales and SBOs have posted remarkably similar figures in the past six months indicating a narrowing of the historic gap between the two types of exit.

The number of partial sales has also markedly increased over the past few years, claiming its largest market share since the crisis.

In the period from September 2012 to February 2013, SBOs were the most popular form of exit in France and the Nordic region, while trade sales took the lead in all other European regions.

In total, 72 trade sales were completed across Europe in this time period, alongside 60 secondary buyouts, according to unquote" data. Partial sales stood at 25 deals. This compared to 111 trade sales in the previous six months (March-August 2012) and 57 SBOs, while partial sales remained steady at 25 deals.

The strongest performing regions in the later period in terms of overall volume of exits were the UK & Ireland (54 exits) and the Nordic countries (36 exits). However, whereas in the UK trade sales dominated at more than twice the number of SBOs (26 vs 12), the Nordic region saw more companies change between private equity hands than snapped up by a trade player. The region recorded 15 SBOs compared to 12 trade sales.

France and DACH came third and fourth in the exit rankings with 32 and 31 exits respectively. Again, the proportion of exit routes differed in both countries. France fell in favour of SBOs (12 SBOs vs 9 trade sales) and German GPs preferred to sell to trade buyers (10 SBOs vs 12 trade sales).

Across Europe, trade sales made up 38% of exits in the period while SBOs claimed a 32% market share. This indicated a historically narrow gap between the two. Between March and August 2012, trade sales stood at a staggering 46.6% compared to SBOs' 24%; in 2011 the gap was almost as wide: trade sales made up 41% of exits while SBOs accounted for only 28%. Indeed, in 2009 unquote" data recorded a market-share for trade sales that was three times that of SBOs.

Partial sales also steadily gained in prominence over the past five years: in 2008, partial sales accounted for only 2% of exits, but that figure steadily increased, reaching 10.5% between March and August 2012 and 13% between September and February 2013.

Most mega-deals over the last six months were trade sales, most notably Cinven's Avio, which was snapped up by GE for €3.3bn, and EQT and AB's healthcare business Gambro Group, which the GPs sold to trade player Baxter International for SEK 26.5bn. In comparison, the largest SBOs in that time period were Aibel Ltd, sold for €1.17bn, and Cerved Business Information, which sold for €1.13bn. This suggests that, as well as volumes, trade sale values could be well above those of SBOs in Europe.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds