SBOs remain resilient in Q2

The increase in larger deals witnessed in the second quarter corresponded with a relative resilience in secondary buyout activity across Europe, according to the latest unquote" Private Equity Barometer.

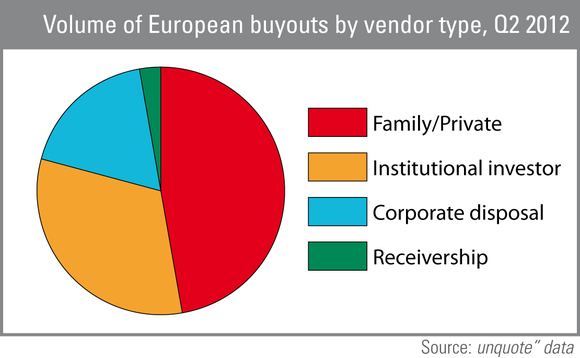

Deals coming from other institutional investors dropped by just five from 28 to 23 between Q1 and Q2 – an 18% decline that compares favourably with the 28% drop in overall buyout activity recorded over the same period.

As a result, SBOs accounted for 34% of buyout dealflow in Q2. This marks a notable increase on the 27% witnessed in Q1 and stands almost on par with last year's figure – looking at 2011 as a whole, SBOs accounted for 35% of all buyouts in volume.

Analysing the buyout landscape based on the overall value of deals reveals the importance of SBOs at the upper end of the market. Nearly 60% of the amounts invested in Q2 can be attributed to SBOs; this is actually up from the 2011 average, when SBOs accounted for 55% of all buyouts in value terms.

Indeed, the largest deal of the quarter came courtesy of EQT buying German medical supplies manufacturer BSN Medical from Montagu Private Equity for €1.82bn. In fact, three of the five largest deals in Q2 were sourced from fellow GPs.

Meanwhile the slump at the smaller end of the value spectrum witnessed in the past quarter correlated with a commensurate decline in deals coming from families and private owners, which saw activity fall by 32% from 50 to 34. The number of transactions being sourced from trade buyers remained steady on 13, though this is low by historical standards, while acquisitions from volatile public markets dried up completely in the second quarter.

For a more in-depth look at the European buyout market in the second quarter, download the latest unquote" Private Equity Barometer.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds