The pitfalls of turnaround investing

Turnarounds are in the news once again, with the decision by specialist investor OpCapita to put struggling electricals retailer Comet into administration. Last week, Deloitte took over the administration of the business, and on Monday made over 300 staff redundant. The case of Comet highlights how tricky it can be to invest in struggling firms.

OpCapita acquired Comet in November last year from previous owner Kesa Electricals, which also provided the firm with a £50m working capital dowry. However, OpCapita's efforts to turn the ship around were not enough to convince credit insurers to reinstate the firm's supplier cover.

There are also doubts about the position of another OpCapita UK turnaround project, Game, which is also lacking in credit insurance. In the wake of Comet's failure, Game CEO Martyn Gibbs raised his head above the parapet to say the firm is doing well and set to make a £20m profit this year, boosted by a string of big console game releases.

Gibbs also claims to have close relationships with the firm's suppliers, reducing the impact of it lacking credit insurance, though it remains a cloud above the firm's head. Furthermore, there is speculation that insurers are unhappy with OpCapita, which refused to pay off the £40m Game owed suppliers when it was placed in administration, meaning they took a hit on the sale.

While the news might be seen by some as a bad advertisement for turnaround and special situations investments, it's worth remembering that a number of turnarounds have been highly successful, and a certain failure rate is expected when taking on such challenging projects.

Last year saw a number of successful turnarounds, among them the fruitful sale of Converteam (previously Alstom Power Conversion) by Barclays Private Equity (now Equistone) and LBO France. The firm had been losing around €20m a year on a €500m turnover. However, Equistone and LBO France were able to successfully turn the business around, growing turnover to €1.4bn and returning to profit. The business was sold for €3.2bn to General Electric in March 2011.

Last year also saw Pamplona sell its stake in TMD Friction, which it acquired from administrators in April 2009. The business had run into trouble the previous year when a sharp decline in orders caused its credit insurance to be cancelled. Pamplona paid €100m for the firm and was able to turn around its fortunes, increasing turnover by 20% and EBITDA by a huge 160%, eventually selling it for €600m in September last year.

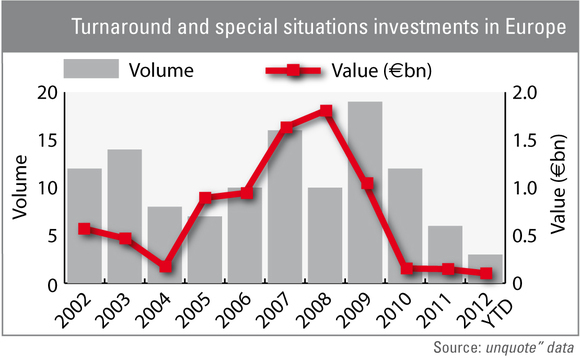

The number of turnaround investments has begun to decline in the past few years (see graph), having peaked at the height of the financial crisis. It remains to be seen whether this is the result of fewer businesses that are struggling or whether those left are simply beyond the point of being saved.

So, while developments at Comet remind us of the difficulties of turning around a struggling business, particularly given the effects of a double dip recession and more long-standing pressures on physical retailers, it's also worth remembering that many good firms are thrown a lifeline by turnaround funds. Not every case will succeed, but recent investments indicate that, in many cases, jobs and businesses can be saved with a solid recovery plan.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds