Capital cities attract most private equity investments

Europe’s capital cities attract the lion's share of private equity investment, though other regions in Europe have been shown to be very active, according to new research from unquote” data.

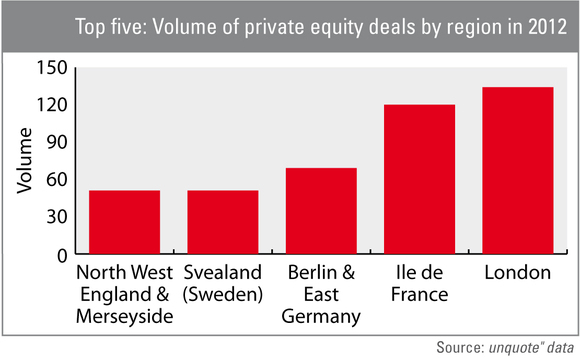

New figures focusing on national regions that received the biggest share of private equity and venture capital in 2012 show Greater London and the Ile-de-France (the French capital region) to be by far the most popular investment destinations. The London area leads the pack, attracting 134 investments in 2012, while the Paris region followed close behind with 120 deals.

In Germany, Berlin is far behind its rivals, with the Berlin & East Germany region seeing just 69 deals last year. German investment activity was generally far more spread out than in the UK or France, reflecting the multiple business hubs seen in the country's various regions.

The story is similar in Sweden, where the central Svealand region, which surrounds Stockholm, saw the bulk of investment activity with 51 investments.

As capital cities tend to attract larger populations, the trend towards investing in these cities is perhaps unsurprising. Larger national and international companies will also tend to base their headquarters in their home nation's capital, adding to this trend.

However, many other regions in Europe have been shown to be very active. Scotland, for example, saw 46 private equity deals in 2012, similar to the far more populous region of South East England, which surrounds London and recorded 48 transactions.

In Germany, Bavaria in particular was very active: it clocked up 31 deals, though several other regions saw high double-digit levels of dealflow as well. Sweden's Gotaland area was also a major investment location, seeing 25 deals in the past year.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds