European retail outshines rest of consumer sector in 2012

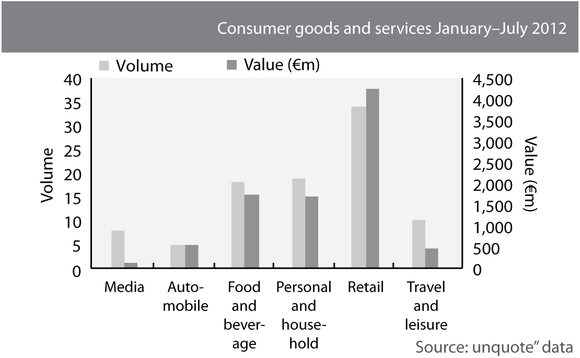

Retail has seen private equity transactions totalling €4.3bn since January 2012, outpacing the rest of the consumer goods and services sector.

Between January and July 2012, 34 deals were completed in the retail sector, amounting to a total transactional value of €4.3bn.

The sector's largest deal was Lion Capital's €800m buyout of French optical retailer Alain Afflelou in March. The company had previously been owned by Apax France, Bridgepoint and Altamir Amboise.

Another large-cap deal that helped the retail space surpass other consumer categories was the secondary buyout of Home Shopping Europe. Rescued from insolvency by Axa Private Equity in 2009, the German business was valued at €650m when Providence picked it up in July.

Meanwhile all other consumer categories lag behind in both value and volume. The food and beverage industry follows with 18 deals worth €1.75bn, while 19 private equity deals in the personal and household goods sector amounted to €1.7bn.

The consumer goods and services sector comprises the media, automobile, food and beverage, personal and household goods, retail, and travel and leisure sub-sectors.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds