Buyout market could see worst year since 2009

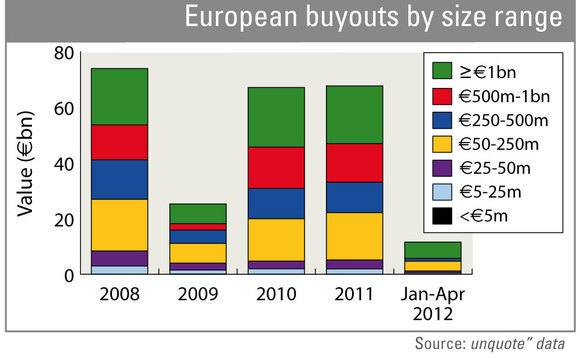

Latest figures show Europe's buyout market has failed to recover from the market malaise of late 2011, brought on by the Eurozone crisis, particularly at the upper end of the market.

The upper mid-market has been particularly badly hit, with unquote" recording just six deals valued between €250m-1bn in the first four months of 2012.

Last year, a number of market commentators predicted deal volumes would recover in early 2012 as banks re-entered the market after the difficult second half of 2011. However, with eurozone problems refusing to go away, along with political upheaval in France and a wave of countries re-entering recession at the end of the first quarter, 2012 is already shaping up to be an even more difficult year for buyout practitioners.

Figures from unquote" data (see chart above) reveal the upper mid-market has been severely constrained at the beginning of the year, with the number of deals seen from January to April painting a bleak picture. While both 2010 and 2011 each saw totals of more than 50 deals in the €250m-1bn segment, there have been just six recorded in this range so far this year. If the market remains subdued then 2012 could see activity even lower than in 2009.

The lower mid-market and small-cap segments have fared better, but will again need to see a significant recovery in deal volumes in the coming months in order to exceed totals for 2011.

unquote" data reports 49 deals worth from €25-250m in the first four months of the year. This compares to a 2011 total of 253. While this market segment has traditionally seen strong dealflow across Europe, the numbers are still set to fall well short of totals in the previous two years.

The reasons for this are varied. Political and macroeconomic concerns are certainly going to dampen optimism and lead to caution among investors, but other factors are also at play.

There have been some reports that valuations are starting to fall after remaining stubbornly high in the post-crisis environment, but this may not lead to a flood of dealflow as those business owners who do not need to sell might be more inclined to ride out the storm and wait for a better valuation.

Additionally, much of the industry is currently in fundraising mode. The early months of 2012 have seen a glut of exits among managers keen to demonstrate that they can sell businesses and return capital to investors. The increasing competitiveness of the fundraising market, coupled with many LPs reducing their exposure or limiting their relationships, could also mean GPs must be so focused on their fundraising that they have little time to focus on new investments, preferring to gain maximum value from their existing portfolio.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds