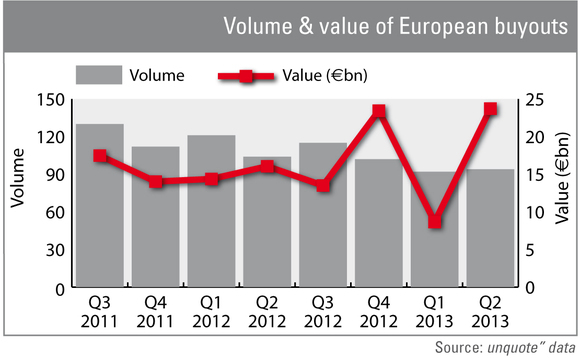

Q2: overall buyout value soars by 174%

The European buyout market recovered spectacularly in value terms in Q2 on the back of a string of mega-deals, but the overall volume of activity remains lacklustre.

The big rise in aggregated buyout deal value over the past three months will be welcomed by many in the industry, soaring 174% from the incredibly modest €8.6bn Q1 total to €23.7bn. Others will point to the lack of progress in volume terms from the opening three months, with a two-year low being improved upon by just two deals to 94 transactions. The year-to-date numbers paint a picture of the divergent underlying trends: value is up modestly by 6% to €32.4bn, while value is down significantly by 17% to 186 transactions.

Unsurprisingly, such a large value increase was primarily the result of a substantial rise in both activity and average enterprise value in the large-cap (€1bn+) category. Just one deal scraped into this bracket in the first three months of the year, yielding an investment total of less than €1.1bn; there were five deals worth close to €10.1bn registered for Q2. These figures are slightly lower than the highest volume and value figures over the past two years recorded in Q4 2012, but did equate to by far the highest average deal value over the sample of around €2bn.

The mid-market (€100m-1bn) range also made a healthy contribution to the bloated collective value total in the second quarter, more than doubling from €5.1bn to €11.3bn. Coming on the back of a modest rise in dealflow of just six deals from 24 to 30, this similarly represented a substantial rise in average value from €213.1m to €375.3m. The mean enterprise value also rose in the small-cap (sub-€100m) bracket from €37.1m to €40.4m, with the volume and value totals respectively dropping by 12% and 4% to 59 deals worth €2.4bn.

Click here to access the unquote" Private Equity Barometer, sponsored by SL Capital.

All data is sourced from unquote" data, the unquote" proprietary database. To conduct your own searches on pan-European private equity trends, visit unquotedata.com

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds