Spread between leverage and all-equity deals widens on investor scepticism

All-equity deals are decreasing as a percentage of overall buyouts, indicating investors are adopting a "wait-and-see" approach to financing.

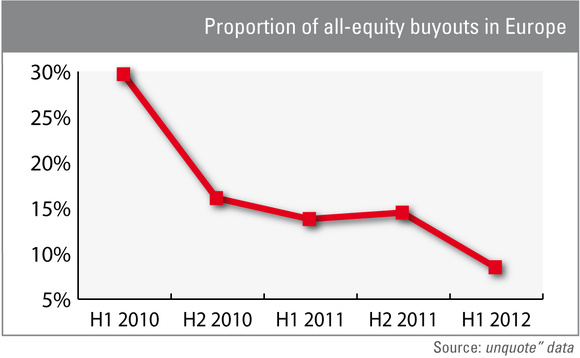

While all-equity deals amounted to 30% of European buyouts in the first six months of 2010, this percentage has shrunk to 8.5% in the first half of 2012. This is despite debt still being difficult to secure.

The narrowing of the spread between leveraged transactions and all-equity deals showed deal-appetite despite poor financing options back in 2010, wheras the lack of all-equity deals today would indicate a weakening of confidence in new investments.

Although overall buyout numbers are down, the percentage of all-equity deals was more severely hit and shrunk to almost half that seen in H1 2011. This is likely due to investor scepticism leading to a "wait-and-see" attitude in the Euroepan market.

Most GPs are aware that banks are lending less than they were pre-crisis. European senior loan volumes have fallen substantially since their peak in 2007, when over €160bn was lent across more than 320 deals, according to data from Standard & Poor's LCD. By contrast, in 2011 this was just a little over €40bn for some 140 buyouts.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds