Ahlsell deal boosts construction sector value total

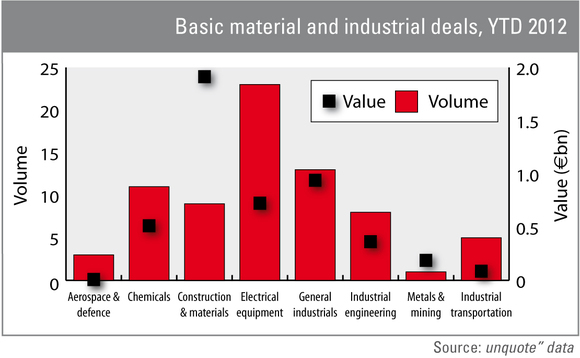

The construction & materials sector has seen €1.9bn worth of private equity deals being completed since January, exceeding the overall amounts invested in other industrial sub-sectors.

The next highest cumulative value is found in the category of general industrials, including packaging, where total investments amount to around €940m.

But the construction industry has been boosted by one deal in particular. The tertiary buyout of tools and construction materials company Ahlsell is the second largest deal 2012 has seen to date. CVC Capital Partners acquired the company for €1.8bn from Cinven and Goldman Sachs Capital Partners. The selling parties had bought Ahlsell for €1.3bn from Nordic Capital in 2006.

In volume terms, however, the electronic & electrical equipment sector proved to be the most attractive, with 23 buyouts completed since the beginning of the year – against nine for the construction & materials sector. With investments worth an overall €725m, the electronic & electrical equipment industry was the third most active industrial sector in value terms.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds