"Pass-the-parcel" deals creep up in H1

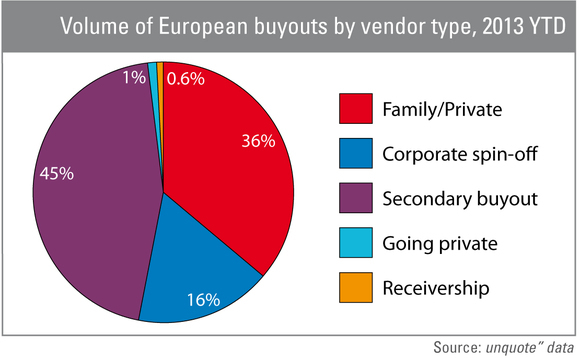

Secondary buyouts have accounted for 45% of the overall number of buyouts in the first half of 2013, the highest proportion witnessed since the onset of the financial crisis, according to unquote" data.

SBOs appear to be proving increasingly popular with GPs – if not necessarily with their investors. Large amounts of capital in private equity funds are still left undeployed given the relatively lacklustre dealflow prevalent since last year – at the same time a significant number of businesses are still sitting in fund portfolios, which makes secondary buyouts an appealing proposition to GPs in both investment and exit mode.

This was particularly evident at the larger end of the market in the first half of 2013, as usual: nearly 60% of European buyouts valued in excess of €500m were sourced from fellow GPs, a figure similar to 2012's. Looking at the largest buyouts of the first half indeed reveals that three out of the top five were SBOs. The two largest deals of the year, Ista (€3.1bn) and Springer Science (€3.3bn) were transacted between GPs.

Given these sizable mega-SBOs taking place in the second quarter, H1 2013 also saw SBOs significantly contribute to the buyout segment in value terms: such deals accounted for 65% of all buyout activity value-wise, the highest half-yearly figure recorded for more than two years. By comparison, SBOs amounted to 39% of all buyouts in value terms in the first half of 2012.

All data is sourced from unquote" data, the unquote" proprietary database. To conduct your own searches on pan-European private equity trends, visit unquotedata.com

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds