DACH buyout market outweighs neighbours in Q2

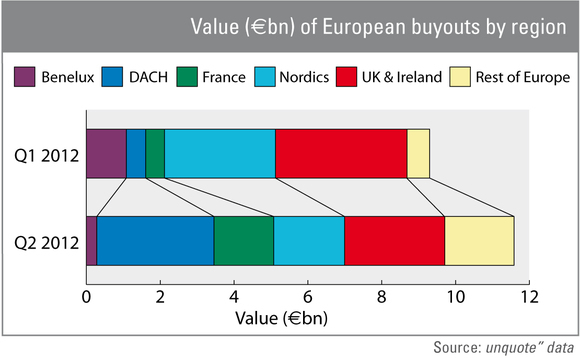

Buyouts in the German-speaking region have shown a significant gain in value from the first to the second quarter of 2012, enabling the region to top the regional aggregate value table.

The €1.8bn buyout of BSN Medical and the acquisition of Swiss VAT refund business Global Blue translated to a strong uptick in value terms, with the DACH region recording a more than six-fold rise from €525m in Q1 to close to €3.2bn over the past three months.

This surge meant that the region topped the regional table for value in Q2, edging ahead of the UK which dropped by 24% from €3.6bn to €2.7bn. The UK remained far and away the most active region with 30 deals completed, 32% less than in Q1 but still three times more than the 11 deals recorded in the Southern Europe region encompassing Italy, Spain and Portugal.

Even though the DACH region's value surge was heavily impacted by the two mega deals mentioned above, the €3.2bn aggregate investment total for Q2 is an impressive figure in the current climate.

Moreover, the duo of large-cap deals points to a healthy supply of debt financing from a comparatively stable domestic banking sector. As a case in point, the BSN deal, the largest of the quarter, was believed to be more than 60% leveraged with a debt package arranged by Deutsche Bank, among others. They also reflect the robustness of the regional economy and particularly that of its dominant constituent Germany, whose export-driven economy avoided the worst ravages of the financial crisis by virtue of the country's typically cautious credit culture.

Importantly, both transactions were also secondary buyouts, of which there were three for the quarter overall. Acquisitions from other institutional investors, a preponderance of which is often seen as an indicator of confidence on the part of debt providers, have been a staple of the DACH investment diet in recent years. In the nine quarters since the corresponding period two years ago, SBOs have accounted for more than a quarter of dealflow in seven instances and have represented the lion's share of aggregate value in four. For the three months to June this year, the total value of buyouts from other private equity houses stood at close to €3bn, 94% of the overall regional figure.

This is an excerpt from the unquote" Private Equity Barometer Q2 2012. Download it in full HERE.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds