Nordics' role in European PE strengthens in H2 2011

The Nordics saw a strong first half of 2012, driven by a few large deals, pushing aggregate value from €3.4bn in H2 2011 to €5bn, showing the region's resilience to the eurozone crisis and its economic strength.

Most notably, Ahlsell changed hands from Cinven and Goldman Sachs Capital Partners to CVC Capital Partners for €1.8bn, making up for the previous quarter's paltry show. Nonetheless, local players have supported the mid-market well, particularly Nordic Capital, which took the lead with a staggering five deals: Orc Group, Bladt Industries, Europris, Tokmanni Group and Sport-Master.

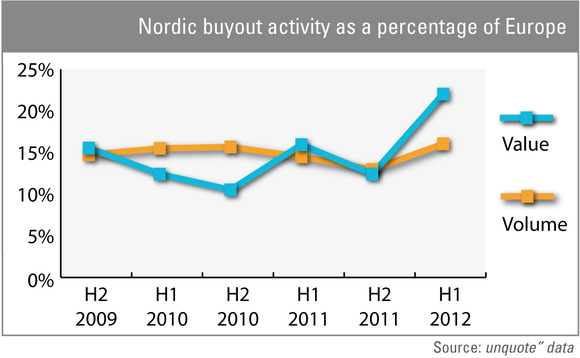

The statistical boost from last year's second half illustrates the region's resilience. Looking at Nordic deal volume and value as a fraction of European deal activity, the region even breaks its H1/2011 record, accounting for more than a fifth of European deal value.

Likewise, deal volume stood at 16% of European transactions, just above H2/2010 and the highest level since Lehman's collapse. Average deal value stood at €168m, on par with H1/2011 and considerably more than the €135m average over the measured period.

While the data partly bears testimony to the macroeconomic delight of the region, unquote" has, for some time, followed a number of key trends facilitating Nordic buyout activity. Firstly, banks are still willing to lend, but "[they] are very selective, based on previous relationships," according to one GP partner speaking on the capital structures panel at the unquote" Nordic Private Equity Congress in Stockholm this summer.

Secondly, new LPs on the block are adding firepower to Nordic war chests, treating the region as a safe haven. As previously reported, international investors are grabbing a larger share of funds, leading to oversubscription in a climate where others are struggling to hit their targets.

Thirdly – and adding weight to the previous points – local GPs are well-networked and highly experienced. As discussed in our recent Nordic report, funds and deal sizes are steadily growing in the region, and industry-supporting professionals readily testified to the fine quality of buyout houses.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds