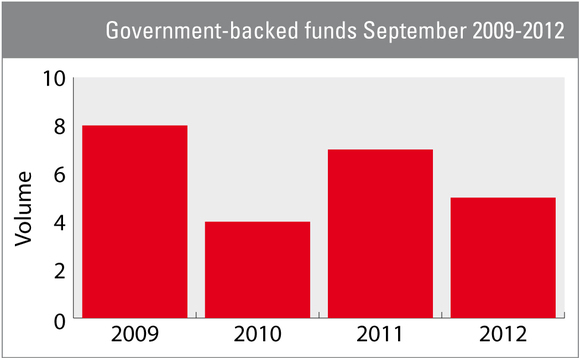

2012 sees fewer state-backed funds

Fewer government-backed funds have been launched in 2012 than in previous crisis years, suggesting that either the market is picking up, or that even governments' aid efforts are failing.

In 2009 and 2011, government-backed investment fund launches spiked due to sluggish economic performance. In 2012, however, the number of taxpayer-backed funds has declined.

Only five funds involving state initiatives launched this year, down from eight in 2009 and seven in 2011. The reasons could be twofold. Either, previous government action has led to the financial services industry to revive and stabilise. However, considering the most recent monetary policy announcements around the world, this option does not seem likely.

Alternatively, a decrease in government-backed funds, could indicate that capital reserves cannot cope any more. Many countries, in Europe and globally, have launched or announced initiatives to jumpstart small business productivity.

Yet, fund launches remain scarce and a recent ECI survey showed that access to financing is one of the prime concerns of SMEs. As the economy remains stuck in crisis, governments will likely need to continue sponsoring businesses.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds