Secondary buyouts reach new heights

Four out of 10 European buyouts were sourced from other GPs in 2015, according to the unquote” proprietary database, marking the highest level recorded for several years. Vidur Sachdeva reports

Although a controversial and much commented upon trend, the rise of secondary buyouts (SBO) has undeniably been a strong phenomenon accompanying the growth of the European private equity industry over the last 15 years.

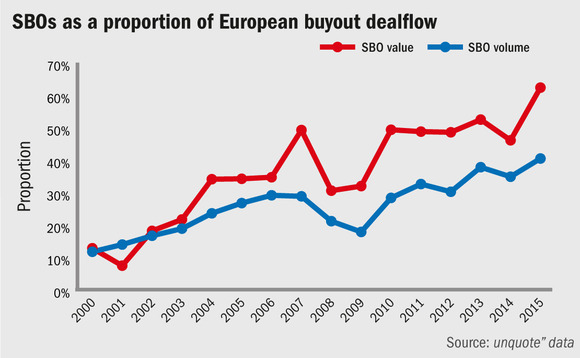

According to unquote" data, 581 buyouts worth €125.6bn took place across Europe in 2015. Of these, 235 deals were SBOs, valued collectively at €78.3bn. In other words, SBOs accounted for 40% of buyout volume and 62% of buyout value in Europe. This marks the steady and significant growth of the European SBO market as these transactions accounted for a mere 12% of buyout volume and 13% of value back in 2000.

In fact, the largest private equity transaction in Europe in 2015 was an SBO: Warburg Pincus- and General Atlantic-backed Santander Asset Management's €5.35bn merger with Unicredit's Pioneer Investments. The deal valued Santander AM and Pioneer at €2.6bn and €2.75bn, respectively. Another notable SBO included Hellman & Friedman's acquisition of Bain Capital's stake in Swedish monitored alarm systems provider Securitas Direct Verisure Group, which was jointly owned by the two US GPs.

SBOs often draw the ire of LPs, especially if they have invested in both private equity firms involved in the SBO, with the obvious concern being that the additional layers of fees might eventually hinder returns.

On the other hand, it can be argued that the different focus and skillsets of multiple GPs often helps to add value to portfolio companies. A recent research paper by the Harvard Business School found that "SBOs made by buyers under pressure to spend capital (a minority of transactions) underperform and destroy value for investors [...], [while on the other hand] when the buyer and seller have complementary skillsets, SBOs generate significantly higher returns and outperform other buyouts. Investors do not pay higher total transaction costs as a result of SBOs, even if they have a stake in both the buying fund and the selling fund."

Either way, it is amply evident that the secondary buyout market has become an important part of the private equity industry model, with many industry experts confident that these transactions are here to stay.

Besides the aforementioned Pioneer and Securitas deals, the following are five of the largest SBOs that took place last year.

1. Autobahn Tank & Rast – €3.5bn (est); August 2015

Germany was home to the third largest SBO of the year – Allianz Capital Partners led a consortium of investors to acquire German motorway services operator Autobahn Tank & Rast, 10 years after selling the business to Terra Firma. Although the enterprise value for Tank & Rast was not disclosed, press reports placed it around the €3.5bn mark. Should it be confirmed, the figure would represent a three-fold increase on the price Terra Firma paid 10 years ago. According to the GP, the partial sale generated a 5x return, with the final exit upping this multiple further.

2. Douglas Holding – €2.8bn (est); June 2015

The German secondary buyout market was home to yet another €1bn+ SBO when CVC Capital Partners acquired German beauty product retailer Douglas from Advent International. The Kreke family, which manages the business, reinvested for a 15% stake as part of the reported €2.8bn deal. Advent had acquired Douglas via a public tender offer in 2013, in a deal valuing the business at around €1.5bn.

3. New Look – €2.6bn; May 2015

Brait Private Equity acquired a 90% stake in New Look in the UK for approximately €1.1bn, providing an exit for Apax Partners and Permira after 11 years. The deal saw New Look's founders, the Singh family, acquire the remaining 10% stake. Apax and Permira claim New Look has become the UK's second-largest women's wear retailer in terms of market share, and the market leader for under-25 women's wear.

4. ICBPI – €2.2bn: June 2015

Advent International, Bain Capital and Clessidra acquired Italian banking services provider Istituto Centrale delle Banche Popolari Italiane (ICBPI) in a deal valued at €2.2bn. The selling shareholders reinvested for an 8% stake in the business, which is seeking to expand both organically and via bolt-on acquisitions. The private equity consortium entered exclusivity for ICBPI in May, having overcome competition from US firm Hellman & Friedman and two private equity consortiums – the first consisting of CVC Capital Partners and Permira, while the second comprised BC Partners and Cinven.

5. Virgin Active – €1.8bn; April 2015

Continuing a trend of private equity activity in the fitness and health club sector, CVC Capital Partners sold its 51% stake in fitness chain Virgin Active to South African listed private equity firm Brait for approximately €1.8bn (around 10.5x EBITDA). Brait stated the equity value of the deal was €1.2bn, and reports suggest CVC more than doubled its original investment. The exit also saw Virgin Group sell down part of its stake from 49% to 20%, excluding management. Brait held an 80% stake in Virgin Active following the transaction, including the shares held by existing management. CVC's exit came nearly four years after it acquired its 51% stake in Virgin Active from the Virgin Group, in a deal with an estimated enterprise value in the region of €1.2bn. The deal was a balance sheet transaction for Brait, and was the result of a dual-track process that included plans for a €2.1bn listing on the Johannesburg Stock Exchange.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds