Mediq deal to boost 2012 P2P figures

The planned €775m takeover of Dutch pharma company Mediq by Advent could help boost public-to-private (P2P) activity figures, which have been on the wane since 2010.

Advent International announced on Monday it would make a €775m takeover offer for Mediq – a 53% premium on the company's current trading price. The process is expected to start in Q4 this year. Fellow heavy-hitter Carlyle is also on its way to take German market data provider Vereinigte Wirtschaftsdienste (vwd Group) private in a deal that would value the business at €72.1m.

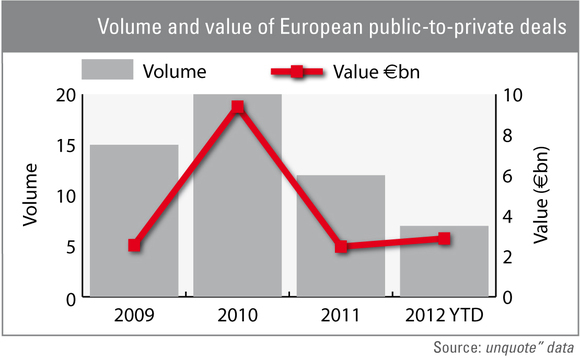

Despite these encouraging signs, listed companies have failed to whet the appetite of private equity players in the wake of the financial crisis. Figures from unquote" data reveal that P2P activity has been on a downward slide since 2010: last year's 12 deals worth an overall €2.47bn were down by 40% in volume and nearly three quarters in value compared to 2010 figures (see chart above). The fall is even more apparent when taking into account the €40bn invested across 36 transactions in 2007.

This year is unlikely to improve much on 2011 figures volume-wise, with seven deals completed so far and another two on the way. But at a combined €2.87bn, the overall value of P2Ps completed so far in 2012 has already exceeded the amounts invested in the whole of last year – and the figure is likely to see a significant boost if and when the Mediq take-private goes ahead.

Much of this value uptick was driven by the Misys deal, completed in June: Vista Equity Partners delisted the British banking software provider for £1.27bn. This was Europe's largest P2P transaction in nearly two years, following up on the £2.89bn, Onex Partners-led buyout of UK engineering and manufacturing company Tomkins in July 2010.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds