Articles by Katharine Hidalgo

AEA aquires majority stake in Battery-backed PST

PST is a group of seven companies in Battery Ventures XI fund, which closed in 2016

Cinven, BCI to acquire Compre from CBPE

This is Cinven VII's third acquisition following the purchase of LGC and Thyssenkrupp Elevator

Perwyn acquires Agilitas from NVM for 8.4x returns

Agilitas recorded revenues of £12m in the year to March 2019, up from £9m in the same preceding period

Mobeus exits Vectair for 8.3x return

Oxbow seeks to invest in mid-market companies with a revenues range of $20-250m

Kinnevik leads $70m series-C for HungryPanda

Kinnevik joins new investors Piton Capital, BurdaPrincipal Investments and VNV Global

Mobeus sells stake in Advantedge for 30% IRR

Mobeus reported a 2.7x return on the sale to ECapital, a provider of alternative financial products

Capita in exclusive talks with Montagu to sell its ESS division

Capita engaged with Goldman Sachs in June 2020 to sell the asset for around £500-700m

CVC makes €175m offer for Vivartia

Marfin Investment Group, the Greek financial entity, is the vendor of the company

Kartesia in €32m refinancing for Enterprise-backed Nu-Med

Enterprise Investors acquired a minority stake in the oncology company in 2013

LDC sells NBS to TA-, Stirling-backed Byggfakta

Bank of America was given the mandate to run the sale process for the company in September 2020

GP Profile: Tyrus banks on quick secondaries turnaround

Waldner says the firm looks to raise €200-250m every 12-15 months and is now raising its fifth fund

VCs in €3.5m round for Cumul.io

Stijn Christiaens, co-founder and CTO at Collibra, will continue to act as an independent board member

H2 acquires Optegra

Vendor of the ophthalmology company is Eight Roads, Fidelity International's private equity arm

LDC sells Panther Logistics to trade

LDC's Midlands team originally invested in 2016 as part of a £17m management buyout

NorthEdge invests in Altia-ABM

Fresh investment from NorthEdge backs Altia-ABM's newly promoted CEO Rob Sinclair

Keyhaven sells PIC for 1.7x return

Keyhaven's latest direct investment fund was Keyhaven Capital Partners IV, which closed on £74.2m

BGF takes minority in Datum360

Datum360's fresh funding will be used to accelerate growth and address market demand

RB Ventures invests in Oxwash

RB Ventures' Fabrice Beaulieu will take a position on the laundry company's board

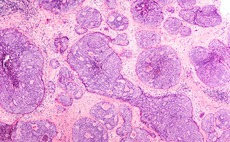

Ardian buys Inovie minority

Ardian has acquired a minority stake in medical diagnostics company Inovie.

Apax acquires majority of Diapason

Founder Pascal Kravitzch and Diapason's management team also invest significantly in the deal

CBPE X closes on £561m hard-cap

Rede Partners acted as global placement adviser and Macfarlanes as legal adviser

Sovereign exits BIMM to ICG

Sovereign Capital Partners backed the buyout of BIMM with a £10m investment in April 2010

LDC invests in Ross Trustees

Banking facilities for LDC's management buyout of the trustee company are provided by HSBC

CVC provides £37.5m financing for Sovereign-backed Nurse Plus

Sovereign Capital purchased Nurse Plus from previous sponsor Key Capital Partners in 2015