Articles by Harriet Matthews

Turnstone PE heads for debut fund first close in March

Sponsor formed by ex-Argentum team seeks to raise EUR 100m for vehicle focusing on mature primary and secondary opportunities

Women in PE: Schroders Capital's Lukas on impact investment and supporting GPs through fundraising woes

Tanja Lukas speaks to Unquote about priorities for the asset managerтs private equity strategy

Ocean 14 Capital plans June final close for debut 'blue economy' fund

Article 9 growth fund is expected to exceed its EUR 150m target and will back 20-25 businesses

Triton on the road for Fund VI with EUR 5.5bn target

Latest flagship fund aims to raise slightly more than its EUR 5bn, 2018-vintage predecessor

Unquote Private Equity Podcast: Après IPEM and the road ahead

Harriet Matthews and Min Ho share what they gleaned from the conference in Cannes and what this means for investment and fundraising outlooks

Planet A raises EUR 160m for debut greentech fund

German VC will back scaleable hardware and software startups, giving science team "veto power" in investment decisions

McDermott adds to German PE team with Noerr and Latham duo

Noerr’s Holger Ebersberger and Latham & Watkins’ Hanno Witt to join the firm’s Munich office

Oakley raises EUR 2.85bn for fifth flagship fund

More than twice the size of its 2019 predecessor, the vehicle will allow for larger equity tickets, more investments and bolt-ons

Brookfield acquires DWS private equity secondaries unit

Asset manager plans expansion into PE GP-leds, bolstering its existing real estate secondaries strategy

GP Profile: Key Capital upbeat about SME deals with next fund in the making

UK small-cap sponsor could return to market for its next GBP 125m fund at the end of 2023

GP Profile: Armen eyes "new frontier" for GP stakes in Europe

France-headquartered GP stakes investor is seeking to support sponsors as they become multi-strategy managers, co-founder Dominique Gaillard tells Unquote

IPEM 2023: GPs battle fundraising blues on the Côte d'Azur

Sponsors remain broadly optimistic despite fundraise bottlenecks and a growing number of LPs faced with tough choices on manager selection

Flight to quality, impact investing to drive allocations in 2023 – HarbourVest

Asset managerтs investment team discusses secondaries and co-investment dynamics amid a challenging fundraising market

Unquote Private Equity Podcast: The PE auction in times of exit scarcity

Rachel Lewis joins Harriet Matthews to discuss how auction process dynamics are changing against the current market backdrop

Arcano holds EUR 450m final close for latest secondaries fund

With just under 50% deployed, the vehicle will split focus evenly between LP stakes and GP-leds

Certior Capital holds first close for second PE emerging managers fund

Fund has a EUR 80m target and will be split evenly between fund investments and co-investments

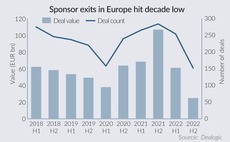

Going, going, not gone: PE auctions bid for relevance amid risk-off environment

With a debt financing drought and macro woes denting exits, GPs are adapting the traditional M&A auction in favour of more flexible bilateral negotiations to get deals across the line

Bellevue eyes Q1 2023 first close for debut secondaries fund

With USD 200m target, vehicle will primarily focus on USD 1m-30m LP stake deals

Dyal raises USD 12.9bn for new fund with CVC, PAI stakes in portfolio

Blue Owlтs division exceeded target for fifth fund specialised in buying minority stakes in asset managers

Hamilton Lane raises USD 2.1bn for fifth co-investment fund

Close comes at a time when challenging credit and fundraising markets are increasing GPsт need for strategic capital sources

Rede Partners opens Amsterdam office

Private capital adviser aims to grow its European footprint with first office on the continent

Arcano holds EUR 280m final close for impact fund-of-funds

Spanish GP is eyeing a second vintage in 2023 with the vehicle more than 50% deployed

General Atlantic holds USD 2.6bn final close for debut climate fund

BeyondNetZero strategy has USD 3.5bn to deploy in total with additional firepower from the GP

Bellevue hires ex-Partners Group trio for new secondaries strategy

Switzerland-based asset manager plans to launch first secondaries vehicle in 2023