Buyouts

Apax leads $1bn Paradigm buyout

Apax Partners and JMI Equity have agreed to acquire oil & gas software vendor Paradigm from US investment group Fox Paine for around $1bn.

Private companies rethink pricing

The recession has had little effect on company valuations, but now companies are becoming more realistic about their value, writes John Bakie

Next Wave acquires Molinare

Next Wave Partners has acquired UK post-production firm Molinare TV and Film Ltd.

OMERS PE acquires Lifeways from August Equity

The private equity branch of Canadian pension fund OMERS has acquired British healthcare services provider Lifeways from August Equity.

Sherpa acquires Dédalo division

Sherpa Capital has wholly acquired Dédalo Grupo Gráfico, the commercial printing division of Dédalo, from Spanish private equity house Ibersuizas and media conglomerate Grupo Prisa.

MML sells Industrial Acoustics to AEA

MML Capital Partners has sold noise control products manufacturer Industrial Acoustics to AEA Investors.

ICG backs Symington's in SBO

Intermediate Capital Group has invested in the secondary buyout of convenience food producer Symingtonтs from Bridgepoint Capital.

Inflexion acquires Marston Group from Gresham

Inflexion Private Equity has bought UK-based judicial services business Marston Group from Gresham Private Equity.

DGPA backs L'Autre Chose

Italian private equity house DGPA has acquired a 55% stake in footwear brand L'Autre Chose for €8m, according to reports.

Capvis buys hessnatur

Swiss private equity firm Capvis Equity Partners has acquired German clothing company hessnatur in a management buyout from Primondo Specialty Group for an estimated €30-40m.

Enterprise Ventures and PHD Equity Partners invest in Barber

Enterprise Ventures (EV) and PHD Equity Partners have invested ТЃ2.7m in the ТЃ4.4m all-equity buyout of British equipment supplier Barber.

Priveq backs MBO of Office Management

Priveq Partners has taken a majority stake in Swedish office supplier Office Management.

Sentica acquires Silta

Sentica Partners has taken a majority stake in payroll consultancy Silta.

Moody's forecasts €33bn+ LBO default

More than a quarter of unrated private equity LBO debt will default by 2015, according to ratings agency Moody’s.

Are mezzanine funds making a comeback?

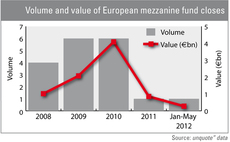

The launch of 123 Venture’s latest mezzanine fund, the €100m Trocadero Capital Transmission II, is the second mezz fund launch this year with CIC Mezzanine III. In parallel, the number of mezzanine funds reaching final close has declined from 6 in 2010...

Fondations Capital grabs 60% of Sepur

Fondations Capital has acquired a 60% stake in French waste collector Sepur from its founder, in a deal that values the business at €124m.

Equistone in €1bn Global Blue exit

Equistone Partners Europe (formerly Barclays Private Equity) has sold travel payment service provider Global Blue to Silver Lake Partners and Partners Group in a €1bn deal.

Nordic Capital acquires Tokmanni from CapMan

Nordic Capital has acquired Finnish discount retailer Tokmanni Group from CapMan.

Mid-cap valuations register modest drop – Argos Index

Modest drop in mid-cap valuations

CBPE buys minority stake in IVF clinic

CBPE Capital has bought a minority stake in London-based Assisted Reproduction & Gynaecology Centre (ARGC).

FSI Régions backs Arcancil Paris MBO

FSI Régions has invested €500,000 in the management buyout of Arcancil Paris.

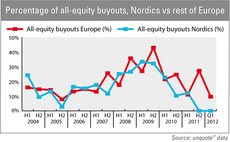

Nordic credit remains more readily available

The Nordic countries have enjoyed a lower proportion of all-equity buyouts than the rest of Europe for several months now - highlighting easier access to leverage in the region.

Invest AG set to buy Philips' Speech Processing unit

Invest AG, the private equity arm of Raiffeisen Banking Group Upper Austria, has agreed to buy Philips' Speech Processing unit.

PEQ backs Inläsningstjänst MBO

PEQ has backed an MBO of educational services provider InlУЄsningstjУЄnst.